Insuring the Mt. Vernon Estate Pocket East of Salem Avenue: A Deep Risk Analysis for Homeowners

In Dayton’s Mt. Vernon neighborhood, there is a small and often overlooked estate pocket sitting just east of Salem Avenue — specifically along Red Haw Road, Mt. Vernon Avenue, Fountain Avenue, Wabash Avenue, and Niagara Avenue. This concentration of historic, custom-built homes stands apart from the surrounding grid in both architecture and long-term stability. While the broader area has experienced decades of disinvestment and higher-than-average crime, this micro-neighborhood has remained a quiet, tree-lined enclave with some of the largest early-20th-century residential structures in Northwest Dayton. This article provides a highly detailed insurance analysis for this unique pocket, explaining risks, claims patterns, historic construction challenges, and the coverage protections every homeowner here should prioritize.

Whether you’ve lived here for decades or are considering purchasing one of these impressive pre-war homes, understanding the insurance landscape is essential. Older construction, adjacency to higher-risk corridors, and the aging infrastructure that characterizes this part of Dayton all influence premium costs, inspection outcomes, and claims experiences. This guide will help you make informed decisions, anticipate insurer scrutiny, and protect one of the most distinctive housing pockets in the city.

The Mt. Vernon Pocket: Understanding This Distinct Residential Enclave

Although officially part of Dayton’s Mt. Vernon neighborhood, the streets east of Salem Avenue — particularly Red Haw Road, Niagara Avenue, Mt. Vernon Avenue, Wabash Avenue, and Fountain Avenue — are uniquely different from the rest of the area. These streets form a small, curved-grid residential pocket characterized by:

- Large, early-1900s custom homes—many with brick, stone, or heavy wood framing

- Deep lots and wide setbacks uncommon in nearby blocks

- Mature tree canopy that creates both charm and elevated storm risk

- Architectural diversity spanning Colonial Revival, American Foursquare, Tudor, and early Craftsman influences

- Long-term owner occupancy compared to more transient nearby streets

The result is a micro-neighborhood that feels substantially more stable and historically affluent than the surrounding area. While the broader Salem Avenue corridor has gone through decades of economic change, this pocket has consistently attracted homeowners who value craftsmanship and lot size, often maintaining these properties through generations.

A Rare Estate District Within Northwest Dayton

Few parts of Northwest Dayton contain homes of this size and complexity. Many houses in this pocket were built between 1905 and 1935, designed during an era when Dayton was booming, and affluent families sought suburban-feeling residential enclaves just outside downtown. These homes often feature:

- Hardwood flooring milled from old-growth lumber

- Original stone or brick exteriors

- Hand-laid tile, fireplaces, built-ins, and custom trim work

- Large attics and basements compared to modern construction

- High-pitched roofs and complex rooflines

While these features make the homes architecturally significant, they also create insurance challenges. Insurers know that repairing pre-war craftsmanship is expensive, time-consuming, and rarely matches modern construction methods. This affects how policies are underwritten — and what protections a homeowner must consider.

The Surrounding Risk Environment: Salem Avenue, Crime Patterns & Insurer Perception

One of the most important factors affecting insurance in this area is the surrounding environment. While the estate pocket itself is quiet and stable, it is immediately adjacent to streets and corridors that experience higher-than-average levels of property crime, vandalism, and auto-related incidents.

How Insurance Companies View Risk Radius

It’s important to understand that insurers do not underwrite a single street in isolation. Most companies evaluate risk based on:

- ZIP code-level crime data

- Historical claims within a multi-block radius

- Proximity to major roads — in this case, Salem Avenue

- Fire department response zones

- Local infrastructure conditions

Even though the Mt. Vernon pocket is a stable enclave, its location between Salem Avenue and nearby higher-crime blocks means insurers treat it differently than comparable homes in Oakwood, Grafton Hill, or the Dayton View Historic District. The result can be:

- Higher premiums

- Stricter inspection requirements

- Higher likelihood of roof, wiring, or plumbing underwriting scrutiny

- More limited carrier options

This isn’t a reflection of the residents or the pocket itself — it’s simply how insurers operate across the country. They use heat maps of prior claims, crime statistics, and actuarial models that don’t differentiate between micro-neighborhoods as precisely as locals do.

Crime Exposure: Understanding Realistic Insurance Implications

While this pocket is safer than the surrounding area, adjacency still affects coverage considerations. Common claims near the Salem Avenue corridor include:

- Auto break-ins and glass damage

- Package theft

- Detached garage vandalism

- Theft of lawn equipment from sheds

- Occasional burglary attempts (though far less frequent within the pocket)

Homeowners here should be prepared for insurers to apply higher deductibles for theft, require photos or proof of security upgrades, or limit certain older homes unless safety conditions are documented.

Recommended Crime-Related Coverages

- Replacement Cost Personal Property — avoid Actual Cash Value

- Scheduled coverage for high-value items (jewelry, collectibles)

- Extended theft protection for detached structures

- Coverage for stolen landscaping equipment

Homeowners should also consider upgrades such as security cameras, reinforced doors, motion lighting, and garage alarms — all of which can lower risk and help with claims approval.

Aging Construction: Why These Homes Require Specialized Insurance Attention

Homes in the Mt. Vernon estate pocket are beautiful, but their age introduces substantial insurance complexity. Many carriers will either:

- require an inspection,

- exclude certain systems from coverage, or

- decline the home entirely without upgrades.

Common Aging System Issues Insurers Flag

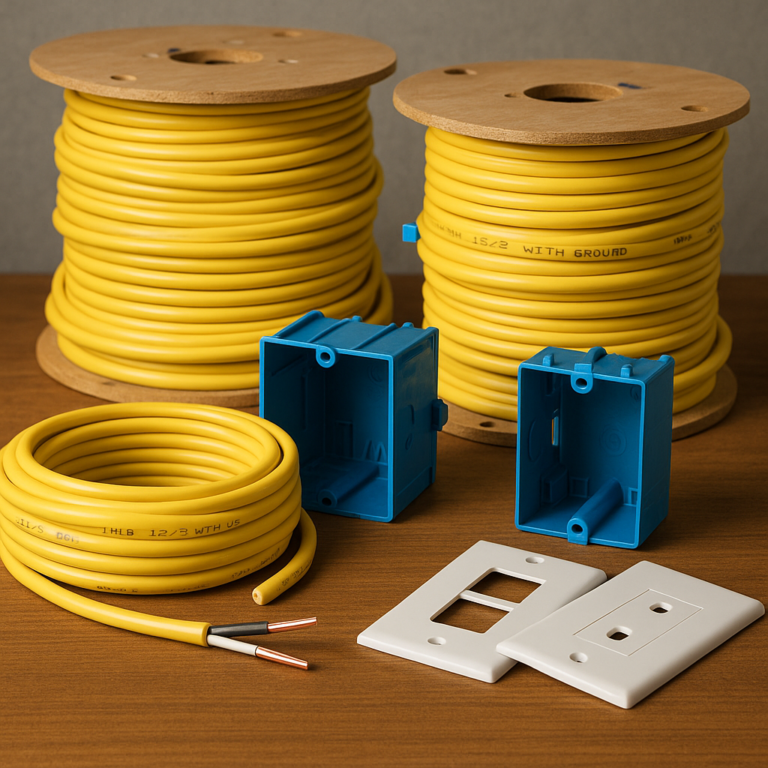

- Knob-and-tube wiring

- Fuse boxes rather than breaker panels

- Galvanized or cast iron plumbing with corrosion risk

- Aging clay sewer lines

- Roof age exceeding 20–25 years

- Foundation settling or moisture intrusion

- Old furnaces or oil-burning heating systems

Because of this, homeowners must be more proactive about maintaining documentation. Photos of updated systems, receipts from contractors, and inspection reports make underwriting significantly smoother.

Replacement Cost vs. Actual Cost: The Biggest Issue

The cost to replicate original materials in these homes is extremely high. Carriers factor this into premiums because:

- Hardwood today is not the same species or quality as early-1900s lumber

- Plaster walls require specialty contractors

- Custom millwork must be recreated by artisans

- Historic windows require complex repair or replacement

Because of this, Guaranteed Replacement Cost (if available) is strongly recommended.

Tree Canopy & Wind Risk: A Major Source of Claims

The mature tree canopy throughout this pocket is one of its most beautiful features — but it also represents a major insurance risk. High-wind events in Dayton have increased over the past decade, producing a notable uptick in claims involving:

- Fallen trees on roofs

- Detached garage damage

- Fence collapse

- Downed power lines

Because these homes sit on deep lots with large trees, it is not uncommon for insurers to request evidence of tree maintenance or even decline homes with visible dead or leaning trees.

Recommended Wind- and Storm-Related Coverage

- Full Replacement Cost roof coverage

- No cosmetic roof exclusions

- Coverage for fallen trees even when they don’t strike a structure

- Increased limits for other structures if garages are large

Homeowners should also document roof replacement dates and keep photos of tree maintenance to support any future claims.

Sewer, Drain, and Infrastructure Risks

The homes in this area were constructed during an era of clay tile and concrete sewer laterals. Over time, these lines are vulnerable to:

- Root intrusion

- Cracking and collapse

- Backups due to aging city infrastructure

This makes Water Backup Coverage especially important here. Even a minor basement backup can cost thousands between cleanup, drywall removal, flooring replacement, and mold prevention.

This topic is thoroughly covered in our guide on sewer and drain backup coverage in Dayton.

Service Line Coverage: A Must-Have in This Area

Service line failures are increasingly common in older Dayton neighborhoods. This inexpensive endorsement covers damage to:

- Water lines

- Sewer lines

- Electrical lines

- Gas lines

Given the age of these homes, this coverage is one of the highest-value additions a homeowner can purchase.

Auto Insurance Considerations for This Area

The winding residential streets in this pocket feel safe, but adjacency to Salem Avenue and nearby high-traffic blocks creates some elevated auto risks:

- Parked car collisions from cut-through drivers

- Hit-and-runs on Mt. Vernon Ave and Wabash

- Glass break claims

- Theft of catalytic converters

Comprehensive coverage becomes especially important here, even on older vehicles. Dayton’s rate of catalytic converter theft remains high, and proximity to an arterial road increases risk.

If You Park on the Street

Drivers in this pocket should consider:

- Full glass coverage

- Uninsured motorist property damage (UMPD)

- Hit-and-run protection

These endorsements are inexpensive but extremely valuable in neighborhoods with higher surrounding traffic risk.

The Niagara Avenue Lots: Quiet Future Development

In recent years, the large open lots along Niagara Avenue — directly across from the estate homes — have changed hands. While public information is limited, the expectation is that these parcels will eventually see reinvestment or residential development.

This may gradually shift the area’s long-term insurance profile by increasing:

- Lighting

- Activity

- New construction

- Local traffic patterns

For now, however, the lots remain open green space, providing a buffer that contributes to the pocket’s quiet feel.

Key Insurance Coverages Every Homeowner Here Should Have

Essential Insurance Coverages for Homes in the Mt. Vernon Estate Pocket

1. Guaranteed or Extended Replacement Cost

The most critical coverage for homes in this pocket is Guaranteed Replacement Cost (or at minimum, Extended Replacement Cost). These houses were constructed during a period when materials were inexpensive, craftsmanship was highly specialized, and labor was abundant. Today, the cost to reconstruct an early-20th-century home exactly as it stood — with hardwoods milled from old-growth forests, plaster walls, custom brickwork, thick framing, and decorative architectural components — is extraordinarily high.

Standard home insurance policies often cap reconstruction at the declared dwelling limit. If a home is underinsured (which is common in older Dayton neighborhoods), the homeowner becomes responsible for covering the difference. In a full-loss scenario, that difference can reach into the hundreds of thousands. Guaranteed Replacement Cost solves this problem by allowing the insurer to pay whatever is necessary to rebuild the home, even if costs exceed the limit on the declarations page.

Given the unique structural elements, unusual rooflines, masonry details, and specialized labor needed to replicate these houses, this coverage is not optional — it is essential for preserving the financial integrity of the property.

2. Ordinance or Law Coverage

Nearly all of the homes in the Mt. Vernon pocket were built decades before modern building codes existed. When property damage occurs — even a small kitchen fire or partial roof collapse — the repairs must comply with current code requirements. These code-driven changes often include:

- Electrical upgrades to modern capacity

- Plumbing improvements, especially when galvanized or cast iron pipes are encountered

- Energy efficiency requirements for windows and insulation

- Structural modifications to meet present-day load standards

- HVAC system replacements instead of “repair only” options

Without Ordinance or Law Coverage, the insurer will pay only for replacing what existed previously — not the added cost of bringing the home up to code. This leaves homeowners with substantial out-of-pocket expenses. For aging Dayton homes, especially those with original wiring, plaster, chimneys, or framing methods, these code upgrades can be more expensive than the initial repair itself.

3. Water Backup Coverage

Sewer and drain backup is one of the most common claims in older Dayton neighborhoods, and the Mt. Vernon estate pocket is no exception. Many homes still rely on:

- clay tile sewer laterals,

- aging city mains,

- gravity-fed drainage, and

- basements constructed long before modern waterproofing practices.

Even minor backups can require thousands of dollars in remediation — including pump-out, sanitation, drywall removal, flooring replacement, and mold prevention. Standard homeowners insurance does not cover water backing up from drains, sewer lines, or sump failures unless a specific endorsement is added.

Given the age of the infrastructure beneath these properties, Water Backup Coverage should be viewed as mandatory, not optional.

4. Service Line Coverage

Hidden beneath these beautiful homes are aging water, sewer, electrical, and gas lines — many of which were installed between the 1910s and 1930s. Homeowners are often surprised to learn that they are responsible for the portion of these lines that runs from the house to the city right-of-way.

Service Line Coverage is a low-cost endorsement that covers failures caused by:

- root intrusion,

- collapse,

- corrosion,

- frost heave, and

- accidental damage.

Repairs to a collapsed sewer line can easily exceed $8,000–$15,000 depending on depth, length, and soil conditions. With the combination of mature trees, older pipes, and shifting soil in this part of Dayton, service line failures are common and expensive. This coverage offers substantial financial protection for minimal cost.

5. Full Roof Replacement Cost

The Mt. Vernon estate pocket is heavily wooded, with large, mature trees lining nearly every street. While these trees contribute to the beauty of the neighborhood, they also create ongoing exposure to:

- wind damage,

- falling tree limbs,

- granule loss, and

- accelerated aging of shingles due to shade and moisture.

Insurers have become increasingly strict about roofs in older neighborhoods, with many carriers reducing coverage to Actual Cash Value if a roof exceeds certain age thresholds. This can significantly reduce claim payouts and leave homeowners responsible for thousands of dollars in depreciation.

To preserve the full value of a roof claim — especially after a windstorm or fallen tree — homeowners here should verify that their policy includes Full Roof Replacement Cost with no cosmetic damage exclusions or restrictive roof schedules.

6. Personal Property Replacement Cost

Many homes in this pocket contain heirloom furniture, custom built-ins, antique decor, and personal items accumulated over generations. A standard homeowners policy may default to Actual Cash Value for personal property, which accounts for depreciation and significantly reduces payouts.

Replacement Cost Personal Property ensures that items are reimbursed based on the cost to replace them with new equivalents, without deducting for age or wear. This is especially important because:

- fire and smoke damage spread quickly in older homes,

- water losses can impact multiple rooms at once, and

- theft claims can involve electronics, tools, or collectibles.

Given the character of these homes and the typical personal belongings within them, Replacement Cost is a necessary protection to prevent unexpected financial strain after a loss.

7. Increased Other Structures Coverage

Unlike newer subdivisions, many homes in the Mt. Vernon pocket feature large detached garages, carriage houses, or workshops. These structures were often built with the same pre-war craftsmanship as the main home, meaning replacement costs can be substantial.

Standard policies only allocate 10% of the dwelling limit to “other structures.” For example, a $300,000 dwelling policy only provides $30,000 for all detached structures combined — far below the reconstruction cost of a full masonry garage or carriage house.

Homeowners in this pocket should strongly consider increasing this limit to reflect the true value of their outbuildings, especially if:

- garages are brick or block construction,

- structures include lofts or second floors,

- workshops contain tools or equipment,

- carriage houses have been updated or partially finished.

8. Scheduled Personal Property

The architecture and scale of these homes often attract homeowners who appreciate antiques, fine art, jewelry, and collectible items. Standard homeowners policies impose sub-limits — often only $1,500–$3,000 — on categories like jewelry, silverware, firearms, and artwork.

Scheduling personal property adds itemized protection that:

- removes depreciation,

- provides broader loss causes (including mysterious disappearance),

- sets agreed values, and

- streamlines claims.

For homeowners with inherited antiques, vintage furniture, or custom pieces that complement the home’s character, scheduling is an essential way to prevent financial loss.

Why This Pocket Still Stands Strong

Despite its proximity to higher-risk streets, the Mt. Vernon estate pocket remains one of Northwest Dayton’s most architecturally impressive and stable sections. The deep lots, dense tree canopy, and large custom homes give this enclave a charm rarely found elsewhere in the region.

Insurance can be more complex here — but with the right coverage, inspections, and planning, homeowners can fully protect these historic properties while benefiting from the neighborhood’s character and long-term value.

If you live on Red Haw, Mt. Vernon, Niagara, Fountain, or Wabash and want help reviewing your coverage, reach out anytime:

Phone: (937) 741-5100

Email: contact@insuredbyingram.com

Website: www.insuredbyingram.com