East Dayton vs West Dayton Insurance: What the Data Actually Says (Not the Stereotypes)

For decades, Dayton has lived under a simple—but wildly inaccurate—narrative: the East Side is “safer,” more stable, and more desirable, while the West Side is “dangerous,” disinvested, and higher-risk. This belief is repeated constantly in real estate circles, neighborhood Facebook groups, and even casual conversations. But when you dig into what actually drives insurance rates in Dayton—claims data, construction age, proximity to suburbs, fire response times, and real risk scores—this old East vs West stigma falls apart fast. In this long-form guide, we break down the real forces shaping insurance costs in Dayton, using neighborhood-level examples and data-driven analysis that cuts straight through the myths.

East Dayton vs West Dayton Insurance: What the Data Actually Says

Dayton has one of the strongest, most loyal communities in the Midwest. But it also has one of the most persistent myths:

“East Dayton is safe; West Dayton is not.”

You hear it shouted in every YouTube comment, every Reddit thread, every local forum where someone asks, “Where should I buy a rental?” or “What’s the best neighborhood to live in?”

People repeat this belief like it’s gospel, even though:

- most have never read a single crime map,

- don’t understand how insurance risk is calculated, and

- have never stepped foot in half the neighborhoods they’re talking about.

It’s the perfect example of how reputation becomes “fact” simply through repetition.

And as someone who insures homes in every Dayton zip code, including longtime-owner homes, new construction infill, multifamily properties, investors, landlords, and commercial buildings, I can tell you:

The East vs West Dayton safety narrative is dramatically oversimplified, outdated, and flat-out wrong in many cases.

How the East/West Narrative Even Started

To understand how insurance actually works in Dayton, you first have to look at how the city itself evolved.

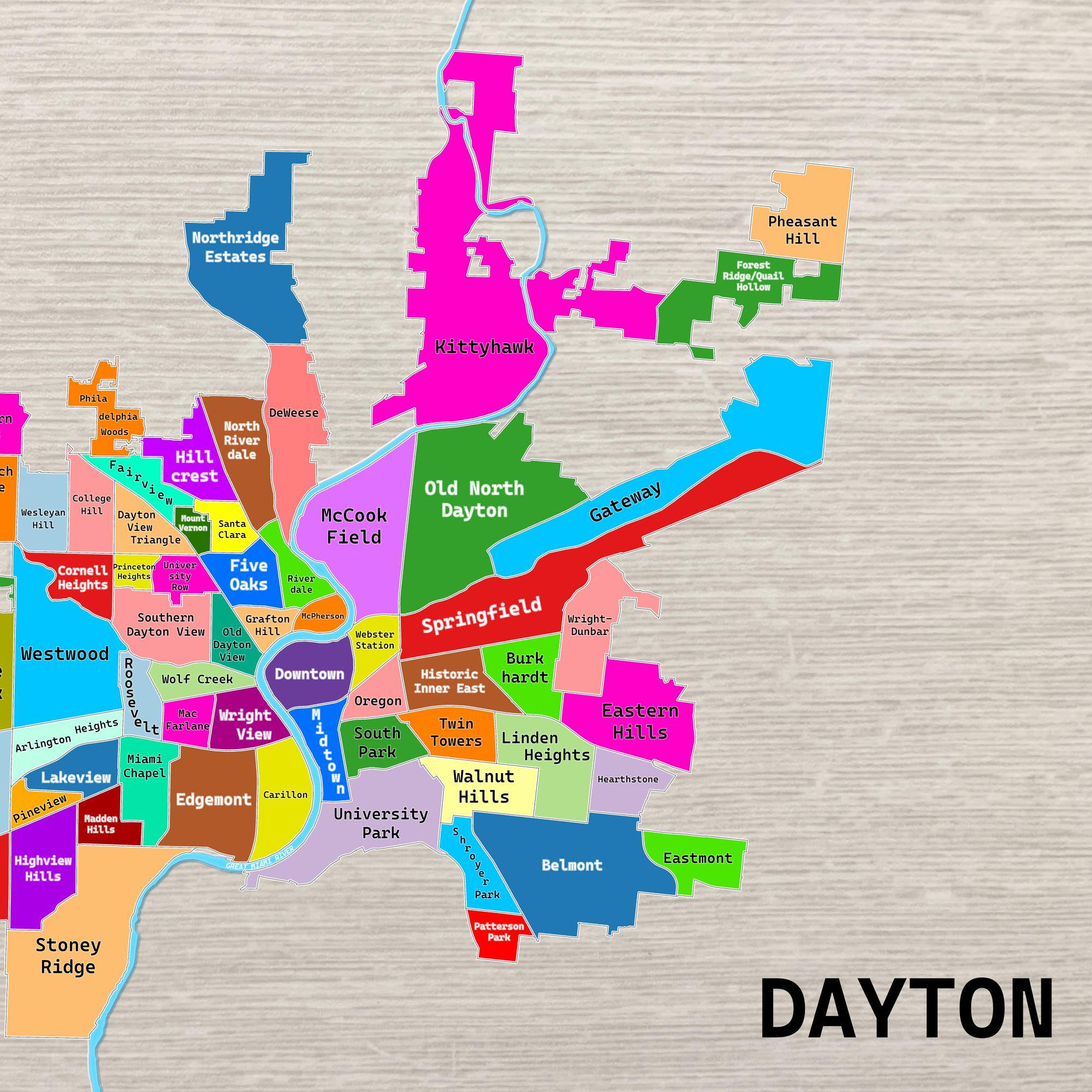

The East Side (neighborhoods like Burkhardt, Kittyhawk, Eastmont, and Twin Towers) grew closer to later-developing suburbs like Kettering and Beavercreek. These areas absorbed mid-century investment, had stable employers nearby, and saw retail corridors grow along Linden, Woodman, and Airway.

The West Side (neighborhoods like Dayton View, Westwood, Residence Park, and Five Oaks) was built earlier, with grander early-20th-century homes, heavy industry, and more railroad-based employment.

Then the perfect storm hit:

- deindustrialization,

- cutbacks in manufacturing,

- highway construction that cut through West Side communities,

- redlining and urban flight, and

- loss of employers in the 1980s and 1990s.

The reputation stuck long after the underlying realities changed.

Today, both sides of Dayton have:

- stable blocks,

- revitalizing corridors,

- distressed pockets,

- new investments,

- long-term homeowners,

- rental density in specific clusters, and

- community-led development.

But the old stories still dominate the conversation.

This matters because insurance companies don’t price policies based on reputation—they price based on risk.

Which brings us to the first huge myth that needs busting.

Myth #1 – “East Dayton Has Way Less Crime”

If you look solely at what people say online, you would assume East Dayton is some utopian haven of peace and West Dayton is a nonstop warzone.

But here’s the truth:

Crime in Dayton does not follow clean East/West lines. It follows micro-clusters around specific streets, retail corridors, and housing density.

Let’s break that down with real neighborhood context.

Burkhardt and Twin Towers Have More Auto Break-Ins than Many West Dayton Neighborhoods

Areas like Burkhardt and Twin Towers are high-traffic corridors. There are lots of cars parked on the street, lots of mixed-use buildings, and lots of foot traffic.

This leads to:

- more catalytic converter theft,

- more smash-and-grabs,

- more porch piracy, and

- higher auto-claim frequency.

Meanwhile, West Dayton areas like Residence Park and many pockets of Dayton View have long-term owner-occupants who know every neighbor on their block.

The claims data reflects it. But the reputation does not.

High-Density Rental Pockets on Both Sides Drive Crime Clusters

Crime is highly correlated with:

- dense rental housing,

- aging multi-family properties,

- older commercial corridors,

- vacant properties, and

- food marts and carry-outs with heavy foot traffic.

Both East and West Dayton have these conditions—just in different forms.

On the West Side, you see clusters around:

- West Third Street,

- the Five Oaks business district (where our offices are proudly located)

- infill around Gettysburg Avenue.

On the East Side, you see clusters around:

- Xenia Avenue retail,

- Wayne Avenue,

- the Burkhardt corridor, and

- stacked retail along Airway and Woodman.

Same conditions → same effects.

A Block or Two Can Change Everything

This is something most out-of-town investors and internet commentators will never understand.

Consider:

- One block of Five Oaks is pristine, tree-lined, and stable.

- The next block has older multifamily buildings needing updates.

- Then one block over, you might see fully renovated brick homes with new roofs.

Dayton is block-by-block, not side-by-side.

East Dayton has the exact same block variability.

But the internet loves a simple story.

Crime Isn’t a Major Driver of Home Insurance Rates

This is one of the biggest misunderstandings you’ll ever encounter when talking with buyers, sellers, or random people on Facebook:

Home insurance does not vary dramatically based on neighborhood crime. It varies dramatically based on claims.

Crime can influence certain claims:

- vandalism,

- theft,

- break-ins, and

- fire/arson (in specific rare cases).

But the overwhelming majority of home insurance losses are:

- water backups,

- wind damage,

- roof failures,

- electrical fires,

- plumbing failures,

- frozen pipes, and

- other weather-related losses.

If you line up 100 home insurance claims from the past few years in Dayton:

- fewer than 5% will be crime-related,

- the vast majority are weather, maintenance, and construction-driven, and

- the number one category by count is wind damage.

East or West doesn’t matter. Shingles curl the same on both sides of I-75.

Which leads straight into the actual drivers of insurance pricing in Dayton.

For now, here’s the key myth-buster:

Crime matters less to insurance pricing than people think — and the difference between East and West Dayton is far smaller than the reputation suggests.

How Insurance Carriers Really Measure Risk in Dayton

Insurance carriers don’t look at your neighborhood Facebook group. They don’t look at what your cousin said about “those areas.” They don’t care about what Reddit thinks of West Third Street.

They look at five primary categories:

1. Claims History (The Biggest Factor of All)

Zip-code-level data, block-level reports, and historical claim frequency are huge. If a small area sees repeated water damage claims or roof-related losses, that will move the needle far more than whether someone on social media thinks a neighborhood is “good” or “bad.”

2. Construction Age & Materials

Carriers care about:

- roof age and material,

- electrical system updates,

- plumbing type, and

- foundation and framing.

A 1920 frame house in Burkhardt and a 1920 frame house in Westwood are not that different to an underwriter if the condition and updates are similar.

3. Fire Response Time

Distance to hydrants, station coverage, and response time matter. West Dayton’s border with more rural areas can have longer response times in some pockets, while inner-city sections on both sides might have very fast fire response but older building stock. The City of Dayton has done a great job providing fire departments resources to equitably to every corner of the city.

4. Proximity to Low- or High-Risk Zones

A house 300 feet from Kettering influences East Dayton risk. A house bordering Jefferson Township or more rural fringe areas influences West Dayton risk. These map lines and jurisdiction borders quietly influence what you pay, even if you never think about them.

5. Home Condition and Updates

This is massively more predictive than “crime.” Updated roofs, modern electrical panels, new plumbing, and well-maintained exteriors do more to lower your risk profile than any neighborhood label.

Almost none of these variables care about stigma. They care about whether claims are likely and how expensive those claims will be.

The Biggest Blind Spot: Reputation ≠ Reality

Here’s the most punchy truth in this whole conversation:

Dayton’s reputational map is stuck in 1985, but the insurance risk map is updated every 12 months based on actual claims.

Insurance companies do not live in the past. They update risk models constantly.

The “East Safe / West Dangerous” narrative? Completely stuck in the past.

In reality:

- East Dayton has pockets with higher auto claim frequency,

- West Dayton has pockets with lower home insurance claims,

- both sides have identical wind damage patterns, and

- roof age trumps crime every single year.

If you took crime out of the conversation entirely, insurance rates in many neighborhoods wouldn’t change much at all.

Neighborhood-by-Neighborhood Examples:

These examples use general data patterns and risk scoring—not subjective judgment or internet rumor.

Westwood

Westwood has a lot of mid-1930s builds and older homes. Many roofs are long past their ideal life expectancy. That roof age matters more than crime — by a mile. When carriers see repeated wind and water claims tied to older roofs, they price accordingly.

Dayton View

Dayton View has huge blocks of historic homes with brick construction and slate or dimensional roofs. Insurance carriers actually like this style of construction — especially when systems are updated. A well-maintained brick home in Dayton View can look very attractive to an underwriter.

Residence Park

Residence Park has more owner-occupants than most outsiders would ever guess. Long-term stability and pride of ownership help keep claim frequency lower. Less churn, fewer neglected properties, and more eyes on the block are all positives from an insurance perspective.

Twin Towers

Twin Towers has higher-density rental properties, which can mean more auto break-ins and more frequent small claims around vehicles and personal property. At the same time, blocks that have seen renovations and strong landlord oversight can have solid home insurance profiles.

Burkhardt

Burkhardt is packed with early-1900s housing. The age itself — not the crime story people tell — pushes insurance costs up. Old roofs, older plumbing, and aging electrical systems drive a lot of the risk conversation here.

Belmont

Belmont benefits from its proximity to Kettering and a more suburban-adjacent feel. That adjacency helps a little in terms of perceived stability and claims patterns. But at the end of the day, roof age is still roof age, and an old, neglected roof in Belmont gets treated the same as an old, neglected roof anywhere else.

Why the Myth Persists Even Though It’s Wrong

This is the part people don’t want to say out loud:

Dayton has an enormous narrative problem.

People outside the city repeat stigma that hasn’t been reality for 30–40 years. People online repeat simplified East/West narratives because:

- it’s easy,

- it fits a pattern,

- complexity is boring,

- nobody reads the data, and

- people love sounding confident about cities they never visit.

But when you’re insuring real homes for real families, patterns emerge fast:

The West Side is not a monolith of crime, and the East Side is not a monolith of safety.

At all. Not even close.

Each side has:

- strong blocks,

- struggling blocks,

- stable long-term residents,

- areas undergoing renewal,

- pockets of rental density,

- pockets of owner-occupancy, and

- blocks that could be in Kettering if the border moved six inches.

Dayton’s reality is far more nuanced — and far more interesting — than the old reputation allows.

The Big Punchline

If there’s one takeaway from everything so far, it’s this:

Insurance in Dayton is NOT divided East vs West. It’s divided by building age, construction quality, fire access, and border adjacency. Reputation plays no role. Claims do.

That understanding is the foundation for digging into why home age and condition — not crime — are the number one drivers of insurance pricing in Dayton.

Why Housing Age and Condition Beat Crime Every Time

If you really want to know why your home insurance is higher in one part of Dayton than another, don’t start with crime maps. Start with a ladder and a flashlight.

What carriers care about most – especially in older Midwestern cities like Dayton – is the age and condition of the home itself. Roofs, wiring, plumbing, foundations, and the general build era of the property will beat neighborhood rumor every single time.

That’s where East vs West Dayton actually starts to diverge in a meaningful way.

Dayton’s Housing Timeline: East vs West

In broad strokes, West Dayton’s core neighborhoods were built earlier. Large portions of Dayton View, Westwood, Residence Park, and nearby streets came online in the early 1900s through the 1930s. You see big front porches, tall basements, plaster walls, and a lot of original framing that has been standing for a century.

East Dayton, in areas like Burkhardt, East End, and Twin Towers, also has early-1900s stock, but there’s more of a blend with mid-century homes as you move closer to suburban borders and corridors like Linden and Woodman.

On paper, a 1920 frame house in Burkhardt and a 1920 frame house in Westwood shouldn’t be treated that differently. The key question isn’t, “Is it East or West?” The key question is:

“What has been updated, and when?”

Roof Age: The Silent Price Tag

If you want the simplest rule of thumb for what moves home insurance pricing in Dayton, here it is:

The older the roof, the more the carrier worries.

Dayton gets real weather. Wind storms, hail, ice, and the kind of “sideways rain” that finds every tiny weakness in your shingles. Once a roof crosses a certain age threshold, the likelihood of a claim skyrockets:

- Shingles start to curl and crack.

- Flashing around chimneys and vents fails.

- Old patch jobs give way under the next serious storm.

That’s where you see some divergence between sides of the city:

- In parts of West Dayton, you’ll see roofs that haven’t been replaced in 25–30+ years on homes already built in the 1920s and 30s.

- In parts of East Dayton closer to Kettering and Beavercreek, you’ll see more consistent re-roofing because values stayed high enough and financing more available.

But, again, this is not an East vs West rule. There are blocks in Dayton View with brand-new dimensional shingles, and blocks in Burkhardt where the roof is hanging on by a prayer.

Carriers are not asking, “Is this west of the river?” They are asking, “Is this roof going to survive the next five years?”

Electrical Systems: Knob-and-Tube vs Modern Panels

Once you get past roofs, electrical systems are the next big lever. Many of Dayton’s older homes – especially those built before World War II – were originally wired with knob-and-tube or early cloth-wrapped wiring. Over time, those systems were partially upgraded, patched, or mixed with newer wiring styles.

Here’s what insurance carriers think when they see “original electrical” and “older panel”:

- higher fire risk,

- higher chance of overloaded circuits, and

- greater uncertainty overall.

When an underwriter looks at a home in Westwood or Five Oaks with original or unknown wiring and an ancient panel, they get nervous. The exact same reaction happens if they see that same setup in Eastmont or Twin Towers.

A fully updated 200-amp panel with modern breakers looks good everywhere. A mix of old cloth wiring, blown fuses, and ungrounded outlets looks bad everywhere.

Again: the system, not the side of town, is what drives risk.

Plumbing and Water Damage: The Hidden Killer of Dayton Claims

Ask any agent who has been in this business long enough: water will bankrupt you faster than burglars.

Dayton has a lot of:

- galvanized steel plumbing in older homes,

- cast iron stacks reaching the end of their lifespan, and

- old supply lines that have been “good enough” for 60+ years.

When those pipes corrode, clog, crack, or burst, they don’t care whether you live in East Dayton or West Dayton. They just dump water into your drywall and flooring.

Carriers know this. They track the age of plumbing systems, the frequency of water damage claims, and the presence of things like:

- sump pumps,

- backflow valves, and

- modernized lines.

A house in Residence Park with updated plumbing will often be a better risk than a house in a “more desirable” East Dayton neighborhood with 70-year-old galvanized pipes and a history of water damage.

Water doesn’t respect stigma. It respects gravity and old metal.

Vacancy, Deferred Maintenance, and Blight

Now, let’s be honest about something that does hit West Dayton slightly harder in some pockets: vacancy and blight.

When you have vacant homes – whether it’s in Westwood, Dayton View, or scattered corners of East Dayton – you raise risk for:

- fire from squatters or vandalism,

- water damage from neglected plumbing and roofs, and

- general neighborhood instability.

But the key is this: vacancy is not a “West Dayton only” issue. You’ll see it on both sides, just with different patterns. And what carriers are tracking is not gossip about a neighborhood; they’re tracking:

- how many boarded homes are nearby,

- how many recent claims were filed in a given radius, and

- whether properties in that area tend to be maintained or left to rot.

A block in East Dayton with multiple vacant duplexes and tired roofs can look worse to an underwriter than a West Dayton block where every homeowner on the street cuts their grass, paints their trim, and replaces their roofs on schedule.

Owner-Occupant vs Investor-Heavy Blocks

Another pattern that affects insurance risk more than “East vs West” is the mix of owner-occupied vs tenant-occupied homes on a given street. This is where stereotypes often get completely flipped on their head.

There are parts of the West Side – especially in areas like Residence Park and stretches of Dayton View – where owner-occupancy is high and has been for decades. Those owners know each other, look out for each other’s homes, and keep their properties in stable condition.

Meanwhile, there are parts of East Dayton – including sections of Twin Towers and East End – that are extremely investor-heavy. You’ll find:

- high tenant turnover,

- more wear and tear on the building,

- less consistent maintenance, and

- landlords who push repairs down the road.

Carriers read that in the claims. They don’t need to be told which side of town it’s on. The claim count speaks for itself.

Detached Garages, Outbuildings, and Yard Layout

One uniquely Dayton quirk that shows up heavily in older neighborhoods on both sides: detached garages and outbuildings.

In Five Oaks, Westwood, and Dayton View on the West Side, as well as parts of Burkhardt and Belmont on the East Side, you’ll see:

- detached garages far back on the lot,

- old sheds and outbuildings, and

- long, narrow driveways.

That layout creates:

- more potential for wind damage to free-standing structures,

- more chances for tree limbs to fall on garages or fences, and

- more surface area for weather to attack.

It also tends to mean more “little claims” over time: a damaged garage roof here, a collapsed fence there, a tree falling on a shed during a storm.

From an insurance perspective, those outbuildings can be covered, but they add to the total risk exposure. Again, the pattern isn’t East vs West. It’s “old Dayton lots with old detached structures” vs “newer suburban-style lots with attached garages.”

Interior Updates and Renovations

A lot of people assume that installing granite countertops or luxury vinyl plank flooring is what impresses an insurance company. It doesn’t.

What impresses an underwriter is:

- a new electrical panel,

- properly vented bathrooms,

- modern plumbing,

- a dry, sealed basement, and

- a roof with plenty of life left.

You can have a fully staged home in East Dayton with pretty finishes and a 30-year-old roof, and it will be a worse risk than a West Dayton home that still has basic finishes but boasts a brand-new roof, panel, and mechanicals.

Looks fool buyers. They don’t fool underwriters.

How This All Shows Up in Your Premium

When the carrier runs your quote, they are feeding in:

- the home’s construction year,

- the last known roof update year,

- square footage and building style,

- distance to fire hydrant and station, and

- prior claims associated with the property or nearby.

All of those inputs have far more impact than the side of town. That’s why you can see:

- a West Side home in Dayton View with updates score a better rate than a neglected property near the Kettering border, and

- a well-maintained bungalow in Belmont come in cheaper than a beat-up duplex in any direction.

The carrier is doing math, not gossip.

What Dayton Homeowners Can Actually Control

Here’s the good news in all of this: while you can’t single-handedly change citywide reputation or erase decades of stigma, you can improve the things that matter most to insurance pricing:

- Replace the roof before it becomes a problem, not after.

- Upgrade the electrical panel and get rid of old, unsafe wiring.

- Update old plumbing and add sump pumps/backups where needed.

- Keep the exterior tight: caulk, paint, seal, and repair.

- Document the work so your agent can advocate for you with carriers.

If you’re in West Dayton and you do these things, you can absolutely beat the stereotype and secure solid coverage at a fair price. If you’re in East Dayton and you ignore these things, you can absolutely end up paying more than you should.

When you strip away the noise, that’s the real story:

Good houses in Dayton — on either side of the river — get better insurance outcomes than neglected houses. Period.

How Suburban Borders Shape Insurance Pricing in Dayton

If there’s one factor that consistently surprises homeowners in Dayton, it’s how dramatically suburban borders influence insurance rates. People assume insurance is about zip codes or “which side of the river you’re on,” but in reality, carriers look heavily at how close your property sits to certain neighboring communities.

In fact, adjacency to suburbs like Kettering, Oakwood, Riverside, and Beavercreek can quietly reduce premiums in certain East Dayton neighborhoods — even when the homes themselves are older or similar in condition to those in the West Side. Likewise, adjacency to rural or semi-rural land near Jefferson Township or unincorporated Montgomery County can nudge rates upward in some West Dayton pockets.

These aren’t absolute rules, but they’re very real trends rooted in decades of claims data.

The East Dayton “Border Effect”

East Dayton borders a cluster of dense, lower-risk suburbs:

- Kettering to the southeast,

- Oakwood slightly southwest,

- Riverside to the northeast, and

- Beavercreek just a few minutes further east.

As you move into neighborhoods like Belmont, Burkhardt, and East End, carriers see patterns in the data:

- homes are closer to newer infrastructure,

- fire response times can be faster due to overlapping service boundaries,

- there’s more consistent street lighting and hydrant placement, and

- there’s more spillover in claims behavior from adjacent suburbs.

The result? Even if two homes are of similar age and condition, the one closer to Kettering might get a slightly better rate simply due to the stability implied by nearby suburbs.

It’s subtle. It’s rarely talked about. But it’s real.

The West Dayton “Rural Proximity Effect”

Meanwhile, on the West Side, neighborhoods like Residence Park, Westwood, and sections of Dayton View Triangle border areas that become more rural just outside city limits.

What does “rural adjacency” mean for carriers?

- longer fire response times,

especially where station coverage becomes thin on the edges, - fewer hydrants and older water infrastructure,

- more trees and more severe storm impact,

- larger lot sizes (more outbuildings to insure),

- higher risk of detached structures being damaged in wind events.

Again, none of this is about crime. It’s about logistics:

If it takes longer to get firefighters, police, or city services to your doorstep, the carrier prices that in.

How Carriers Look at Border Effects

Carriers use mapping software that pulls in:

- distance to the nearest fire station,

- availability of hydrants,

- fire district staffing levels,

- past claim severity in comparable blocks, and

- how often similar home types file specific claims.

When a home sits closer to high-performing suburban fire departments (like Kettering or Riverside), the data often shows:

- faster response,

- smaller fires,

- lower total losses, and

- fewer catastrophic claims.

Conversely, when a home sits on the fringe of a zone with longer average response times — even if it’s still “Dayton proper” — the carrier sees:

- bigger claims,

- more severe damage, and

- higher likelihood of total-loss fires.

Why This Matters for East vs West Dayton Comparisons

This is the nuance almost nobody talks about online:

Suburban adjacency affects insurance pricing far more than the East/West stigma ever did.

That’s why you often see:

- Belmont scoring excellent rates despite older homes,

- East End and Linden-adjacent areas being surprisingly affordable,

- Burkhardt getting moderate but consistent pricing,

- and certain West Dayton blocks seeing slightly higher premiums despite stable, long-term owner occupancy.

It’s not because one side is better than the other — it’s because insurance is math, not mythology.

Where the Borders Blur Completely

Some of the most fascinating examples of this show up in neighborhoods that defy all simplistic narratives:

- Dayton View Triangle – Historic homes, strong community presence, and a unique mix of architecture. Adjacency to Northwest Dayton fire stations and major corridors keeps risk perception balanced.

- Five Oaks – A mix of large historic homes and investor-owned properties. Rates depend far more on updates than geography.

- Belmont – One of the most consistent neighborhoods for insurance despite older homes. The Kettering/Oakwood proximity helps stabilize risk models.

- Residence Park – Tons of owner-occupants. Good exterior maintenance in many pockets. Insurance can be more favorable than outsiders would assume.

These neighborhoods alone prove the point: the East/West myth is too crude to be useful. Carriers slice the map far more intelligently.

The Takeaway on Border Effects

If the home is:

- close to a well-staffed fire department,

- near modern hydrant infrastructure,

- adjacent to stable suburban areas,

- and in a block with low claims frequency,

…it will almost always rate better — no matter which “side” of Dayton it’s on.

And if the home is:

- near rural borders,

- in older hydrant grids,

- further from fire stations,

- or surrounded by high claim density,

…it will rate slightly higher, even if the neighborhood feels stable and quiet.

Geography matters — but not the way people think.

Why Fire Response Time and Infrastructure Matter More Than Reputation

When most people think about what drives insurance costs, they picture crime, theft, or “rougher areas.” But in Dayton — and in most older Midwestern cities — the number one factor that changes the severity of a claim isn’t a break-in or vandalism.

It’s fire response time.

A house fire that is suppressed in five minutes is an insurance headache. A house fire that burns for fifteen minutes before water hits the structure is an insurance catastrophe.

And nothing distinguishes these two outcomes more predictably than hydrant coverage, station proximity, and response logistics.

This is the part of Dayton’s insurance landscape that almost nobody understands — but every carrier studies obsessively.

The Physical Layout of Dayton’s Fire Coverage

Dayton’s fire stations are spread across the city, but the spacing varies dramatically depending on era of development and density. Older neighborhoods on both sides of the river tend to have:

- closer stations,

- more hydrants, and

- better urban coverage.

But the edges of the city — especially those bordering more rural areas — can see:

- longer response times,

- fewer hydrants,

- older water lines, and

- slower water pressure recovery during a fire event.

These aren’t guesses. These are patterns that show up in actual loss severity data over decades.

East Dayton’s Infrastructure Advantage

East Dayton neighborhoods like Belmont, Burkhardt, and Eastmont often have tighter hydrant spacing and quicker response routes due to:

- denser street grids,

- more stations within short distance, and

- faster access to major arterials.

Even if the homes are older, carriers sometimes see:

- fewer total-loss fires,

- faster suppression, and

- more salvageable structures.

That translates directly into lower claim severity averages — which in turn stabilizes rates.

West Dayton’s Rural Border Challenge

On the flip side, neighborhoods such as Residence Park, Westwood, and the western edges of Dayton View Triangle butt up against:

- Jefferson Township,

- Harrison Township,

- unincorporated Montgomery County, and

- semi-rural road networks.

These areas still receive professional, capable fire service — but response times can stretch because:

- stations are farther apart,

- street layouts are less grid-like,

- hydrants are spaced farther, and

- some water mains are older or narrower.

Even a difference of a few minutes can turn what would have been heavy smoke damage in Eastmont into a multi-room fire in Residence Park.

Insurers track those differences down to the block level.

Detached Garages and Fire Severity

Another important dynamic: Dayton’s older neighborhoods — both East and West — have massive numbers of detached garages. These structures are:

- more likely to catch fire unnoticed,

- more likely to collapse before responders arrive,

- more exposed to wildfire embers during dry spells, and

- often wired poorly during amateur renovations.

A detached garage fire doesn’t just destroy the structure — it can spread to:

- fences,

- cars,

- sheds,

- tree canopies, or

- the main home.

The more distance from the fire station, the worse this scenario gets. So while detached garages exist citywide, their risk profile differs based on fire infrastructure.

How Hydrant and Water Pressure Age Affects Claims

Dayton has been steadily upgrading its water system for decades, but many interior blocks — especially older areas — still rely on hydrants that are:

- lower-flow,

- older models, or

- connected to narrower mains.

This matters because during a structure fire, steady pressure determines:

- how long it takes to knock down flames,

- whether embers spread to neighboring homes, and

- how effectively the fire stays contained to a room or a floor.

Eastmont, Belmont, and other East Dayton pockets benefit from some of the densest hydrant grids in the city. Meanwhile, sections of West Dayton — especially as you approach rural borders — can see lower flow rates.

Insurance carriers know exactly where these differences are.

Why Carriers Care So Much About Fire Response Time

Fire is the single most expensive type of home insurance claim short of total tornado destruction.

The average structure fire in a typical Midwestern city can cost insurers:

- $80,000 on the low end,

- $150,000+ for severe burns, and

- $300,000+ for multi-floor losses.

So even a small statistical difference in fire growth or response time becomes a major factor in premiums.

The Overlooked Truth

A home in Belmont could be 100 years old and still receive strong pricing because carriers see:

- excellent hydrant coverage,

- fast response, and

- consistent historical losses.

Meanwhile, a well-kept home in Residence Park might see slightly higher premiums simply because fires burn longer in its grid before suppression begins.

That’s not a knock on Residence Park — it’s pure logistics.

Once You See It, You Can’t Unsee It

If you lay a map of:

- fire stations,

- hydrant grids,

- water main sizes, and

- response times

over Dayton’s neighborhood map, you suddenly understand:

Insurance pricing patterns follow infrastructure, not stereotypes.

The East/West debate is a distraction. Hydrants and travel times tell the real story.

What Dayton Homeowners Can Do About It

You can’t move a fire station or install new hydrants — but you can make your home less vulnerable to fire spread:

- Keep your electrical system updated. Overloaded or outdated wiring causes fires, not neighborhoods.

- Replace old garage wiring immediately. Detached garages are often the ignition point.

- Trim back tree limbs. A single falling limb during a storm can down lines and start a fire.

- Use fire-rated doors for garage-to-house entry.

- Keep fire extinguishers on every level.

None of these steps change your proximity to a fire station — but they significantly reduce the severity of potential losses, and over time, this stabilizes the risk in your area.

And that’s what carriers reward.

Why Auto Insurance in Dayton Tells a Completely Different Story Than Home Insurance

When people talk about “safe” vs “unsafe” neighborhoods, they’re almost always thinking about home insurance. But the moment you switch to auto insurance, the entire map flips upside down. Suddenly the places that people assume are lower risk become higher risk, and the areas that get unfairly stereotyped begin to look pretty average.

Auto insurance risk isn’t about crime the way people imagine it. It’s about traffic density, road design, commuting patterns, intersection layouts, and vehicle exposure. And in Dayton, those factors play out in wildly different ways east and west of the river.

This is the section almost nobody talks about — but every Dayton driver feels in their premium.

The #1 Driver of Auto Rates: Traffic Density

Auto insurers love one thing more than anything else: predictable patterns. And nothing creates predictable patterns like steady, moderate traffic flows with wide lanes and clear sight lines.

Dayton’s East Side — especially in busier areas like Burkhardt, Eastmont, and the Linden–Airway–Woodman corridors — has something the West Side doesn’t:

Far more cars.

More traffic means:

- more fender-benders,

- more rear-end collisions,

- more sideswipes,

- more intersection crashes,

- more parked-car accidents, and

- more insurance claims overall.

And carriers measure all of it.

Why East Dayton Sometimes Pays More for Auto Insurance

People assume East Dayton has lower crime and therefore lower auto rates. But auto carriers don’t care about rumor — they care about claims frequency. And East Dayton, thanks to heavier commercial corridors, often sees:

- more accident reports,

- more vehicle congestion,

- narrower residential streets packed with cars,

- more blind intersections,

- heavier foot traffic, and

- more vehicles parked on the street overnight.

That last one — street parking — is a massive factor. Cars on the street are statistically:

- hit more often,

- broken into more often,

- sideswiped during snow events, and

- damaged during city plowing.

Many East Dayton neighborhoods, especially in dense pockets of Burkhardt and Eastmont, have narrow drives or no driveways at all — meaning street parking is the norm.

Auto carriers see that in the numbers.

West Dayton’s Surprising Advantage in Auto Claims

Now here’s where things flip hard from the public narrative:

Large parts of West Dayton have lower auto accident frequency than East Dayton.

That’s because West Dayton has:

- wider roads,

- fewer cars on the road at any given time,

- more off-street parking,

- fewer commercial corridors, and

- less congestion overall.

Areas like Residence Park, Westwood, and Dayton View Triangle often see fewer total accident claims per capita than highly-trafficked East Dayton routes.

You might see more claims for:

- vehicle vandalism,

- windshield cracks from debris, or

- parked-car incidents on certain blocks,

but fewer of the heavy-impact accidents that happen at high-speed intersections.

The Real Culprit: East Dayton’s Intersections

There are a few intersections and corridors in East Dayton that carriers quietly dread because they generate so many claims:

- Woodman & Airway,

- Linden Avenue curves,

- State Route 35 interchanges,

- Xenia Avenue & Wayne Avenue intersections,

- Smithville Road south of Airway.

These hubs mix:

- fast-moving cross traffic,

- heavy turning flows,

- pedestrians crossing at odd angles,

- dense retail, and

- multiple blind spots created by signage or building setbacks.

West Dayton doesn’t have anything equivalent to these accident clusters at the same scale.

Rural Borders Again: Higher Severity but Lower Frequency

West Dayton’s proximity to rural areas creates a different type of auto risk:

- animal strikes,

- higher-speed crashes on low-traffic roads,

- larger vehicles on wider roads,

- and less lighting in nighttime conditions.

Severity can be higher — but frequency is often lower.

Carriers hate high severity but hate high frequency + moderate severity even more. The latter is exactly what congested East Dayton corridors produce.

Parking: The Silent Killer of Auto Claims

Here’s a factor almost nobody thinks about:

Where you park your car at night affects your premium.

If you park:

- in a driveway,

- in a garage, or

- on a private pad,

your likelihood of damage drops dramatically.

In large sections of West Dayton, especially in Residence Park and Westwood, homes have:

- driveways,

- detached garages, or

- easier off-street parking.

In many East Dayton blocks — especially where homes are tightly packed, like Eastmont and Burkhardt — driveway access is limited or nonexistent, meaning street parking is the default.

Cars parked on the street are:

- damaged more often,

- sideswiped more often,

- broken into more often, and

- hit by plows more often.

Carriers know this with mathematical precision.

Theft: Not the Factor People Think It Is

Here’s the biggest misconception outsiders have:

“Auto insurance is higher on the West Side because of theft.”

Actually, no.

Auto theft is surprisingly scattered across Dayton and does not align neatly with East/West divisions. In fact, some East Dayton pockets see:

- more catalytic converter thefts,

- more smash-and-grabs, and

- more parked-car break-ins

simply because there are more cars present and more foot traffic interacting with those cars.

Theft drives some premium increases, but nowhere near as much as:

- rear-end collisions

- intersection crashes

- street parking damage

- multi-car accidents

And those factors dominate East Dayton more than West Dayton.

Where Auto Rates Even Out

When you get to more interior neighborhoods like:

you end up with a mix of:

- moderate traffic,

- moderate claims,

- mixed parking situations,

- balanced commute routes.

These areas tend to track near each other in the long run — not because of geography, but because of how cars flow through them.

The Punchline for Auto Insurance in Dayton

The real insurance split in Dayton is not East vs West — it’s:

High-traffic corridors vs low-traffic corridors.

Or more specifically:

- East Dayton = more cars, more accidents, more frequency.

- West Dayton = fewer cars, fewer accidents, lower frequency.

The stereotypes are not just wrong — in the auto insurance world, they’re backwards.

What Dayton Drivers Can Actually Do to Reduce Auto Premiums

No matter where you live, you can immediately improve your auto risk profile:

- Park off the street whenever possible.

- Install a dash cam. (Carriers love indisputable evidence.)

- Use defensive driving discounts.

- Keep deductibles reasonable.

- Bundle auto + home for stability.

- Keep a clean driving record — no small claims.

Auto insurance is about math and movement, not myths. And the math says East Dayton drivers file more total accident claims — which is why they often pay slightly more.

Now let’s move into the part of the conversation that brings all of this together and shows why the East vs West debate is hopelessly outdated.

So Which Side of Dayton Is Really Cheaper to Insure?

After sorting through all the myths, all the outdated narratives, and all the oversimplified “East-good / West-bad” talk that floods Reddit and social media, the truth becomes almost embarrassingly clear:

Neither side of Dayton is inherently cheaper to insure.

Not for home. Not for auto. Not for landlord policies. Not for personal property or liability.

What is cheaper (or more expensive) to insure are the conditions that tend to occur in clusters on one side or the other — conditions that have nothing to do with stereotypes and everything to do with data.

If you take away the map and look only at the claims, the story becomes simple:

- Homes with old roofs cost more to insure.

- Homes far from fire stations cost more to insure.

- Homes with dated electrical and plumbing systems cost more to insure.

- Homes near rural borders tend to cost more to insure.

- Homes near major high-traffic roads tend to cost more to insure.

- Cars parked on the street cost more to insure.

None of these facts care about the river. None of them care about narratives. None of them care about social media opinions.

Let’s bring this into sharper focus.

Why “Cheap Insurance Areas” Don’t Follow East/West Lines

When you map the lowest home insurance premiums across Dayton (based on real patterns across carriers), you don’t get a clean line down the middle of the city. Instead, you get a patchwork of pockets where the homes are:

- well-maintained,

- updated,

- close to quick fire response routes,

- in blocks with low claims history,

- and without significant nearby vacancy.

These pockets are scattered across both sides of the city.

You can find them in:

And likewise, you can find more expensive insurance pockets scattered randomly across both sides as well.

The Most Important Line in This Entire Conversation

If you’re going to quote one sentence from this article, let it be this:

There is no meaningful citywide difference in insurance risk between East Dayton and West Dayton — the differences come from housing condition, fire response logistics, and traffic patterns, not from stigma.

This is the truth that destroys the simplistic narrative. And it’s the truth that both homeowners and investors deserve to hear.

The Real Dayton Divide: Block-by-Block, Not East vs West

Dayton is a city of micro-neighborhoods. You can stand in the middle of a street, turn your head left and right, and see two completely different risk profiles depending on which block you’re looking at.

On the same street:

- One block has updated roofs, tidy exteriors, and low claim frequency.

- The next block has aging systems, deferred maintenance, and more claims.

That’s where premiums shift — not because the Miami River divides the city.

Why Belmont Isn’t “Better” Than Residence Park — and Why Residence Park Isn’t “Worse”

Belmont is often cited as a great “value” neighborhood for insurance because it’s close to Kettering and Oakwood. But the real reason Belmont rates well is this:

Belmont roofs get replaced, Belmont systems get updated, and Belmont homeowners tend to keep their properties mechanically sound.

It’s not the geography — it’s the maintenance culture.

Meanwhile, Residence Park quietly competes with it because:

- the homes are sturdy,

- owner-occupancy is strong,

- lawns are kept,

- rooflines are fixed up regularly, and

- people actually watch out for each other’s property.

That’s the stuff underwriters notice.

What West Dayton Actually Has Going For It

For all the stigma that outsiders slap on West Dayton, it has some true insurance advantages:

- Less traffic → fewer auto accidents

- More off-street parking → fewer parked-car claims

- Larger lots → fewer vehicles getting sideswiped or hit

- Lower density → fewer incidental collisions and scrapes

These advantages rarely show up in conversation — but they show up on underwriting spreadsheets.

What East Dayton Actually Has Going For It

East Dayton’s biggest advantage — and the thing that truly moves the needle — is not crime reputation, but:

Proximity to strong suburban fire departments and newer hydrant grids.

If a carrier sees that a home is close to:

- Kettering fire stations,

- Oakwood response grids,

- Riverside hydrant spacing, or

- Beavercreek-adjacent corridors,

it’s a green flag. It means fires get put out faster. It means claims cost less.

And carriers love lower severity.

The Truth Nobody Talks About: Dayton’s Core Is Really the “Insurance Middle”

Not the East Side. Not the West Side.

The real middle ground for insurance pricing — on average — is actually the central strip of Dayton:

- Five Oaks,

- Dayton View Triangle,

- The Wolf Creek corridor,

- Parts of Old North Dayton,

- Parts of Eastern Hills.

These areas have:

- balanced traffic,

- solid fire coverage,

- updated homes sprinkled throughout,

- many owner-occupants, and

- diverse housing ages.

They’re the real “steady Eddies” of the insurance landscape.

The Real Question Dayton Homeowners Should Be Asking

Instead of:

“Is East Dayton cheaper than West Dayton?”

The smarter question is:

“What condition is this home in, and how fast will emergency services respond if something goes wrong?”

That’s the actual predictor of premiums — not stereotypes.

The Most Honest Answer for Homebuyers and Investors

If you’re comparing two properties — one in East Dayton and one in West Dayton — and wondering which will insure cheaper, here’s the real-world advice:

- Look at the roof age.

- Check the electrical panel.

- Inspect the plumbing.

- Check the condition of the garage.

- Stand on the block and count hydrants.

- Look up the nearest fire station.

These details will tell you the truth long before a stereotype ever will.

Why This Article Had to Be Written

Dayton deserves better than lazy narratives. Homeowners deserve better than outdated stigma. And buyers deserve better than internet advice from people who haven’t stepped foot in these neighborhoods.

If you’re going to invest, live, or build in Dayton, you deserve data, not hearsay.

And the data says:

Dayton’s insurance story is far more equal — and far more hopeful — than the East vs West myth suggests.

Now let’s get into what homeowners on either side can do to lower their premiums and protect their homes.

How Dayton Homeowners Can Lower Their Insurance Costs — No Matter Which Side of the City They Live On

After stripping away all the myths, we’re left with a far more empowering truth: Dayton homeowners have significantly more control over their insurance rates than they realize. You can’t change where a fire station is located, and you can’t redesign your traffic grid — but you can dramatically improve the factors that carriers care about most.

Whether you live in Belmont, Burkhardt, Dayton View Triangle, Five Oaks, Residence Park, Westwood, Eastern Hills, or anywhere else — the following improvements have a direct, measurable effect on your premium.

These are the upgrades and habits that matter far more than geography.

1. Replace Your Roof Before It Fails — Not After

The single most influential factor in home insurance pricing is the roof. Period.

A roof that:

- is over 20 years old,

- has visible curling or cracking,

- has patchwork repairs, or

- has missing shingles

will put your home in a high-risk category with almost every carrier.

The harsh truth: a worn roof in a “good” neighborhood costs more to insure than a new roof in a “rougher” neighborhood.

This upgrade alone can drop premiums by hundreds of dollars per year.

2. Update Your Electrical Panel

If your home still has:

- knob-and-tube wiring,

- cloth-wrapped wires,

- a fuse box, or

- a Federal Pacific or Zinsco panel (big red flags),

you are not just paying more — you’re lucky any carrier will write the policy at all.

A modern 100–200 amp panel with grounded wiring dramatically reduces your fire risk and stabilizes your premium.

3. Modernize Your Plumbing

Old galvanized plumbing and aging cast iron stacks are among the biggest sources of water damage claims in Dayton’s older housing stock.

Even a minor leak inside a wall can become a $7,000–$15,000 insurance claim. Carriers know this. They price it.

Upgrading your plumbing (even partially) signals to underwriters that you’re reducing the #1 cause of small-to-medium-size claims.

4. Add Water Backup Protection — The Most Underused Coverage in Dayton

Dayton basements see water. It’s just a fact of our regional climate and soil.

Every homeowner should have:

- a sump pump,

- a battery backup,

- a backflow valve (if applicable), and

- water backup coverage added to their policy.

Believe it or not, adding this coverage — usually $25 to $75 per year — prevents catastrophic out-of-pocket losses and gives carriers confidence you’re managing the risk.

5. Maintain Your Detached Garage and Outbuildings

Detached garages are one of the biggest risk variables in Dayton’s historic neighborhoods. They’re older, more exposed, and often overlooked.

Carriers look at:

- roof age,

- wiring quality,

- cladding condition, and

- structural soundness.

A garage with failing siding and 1950s wiring is practically begging for a claim. Updating these structures stabilizes your premium and protects your biggest assets: the home and the vehicles next to it.

6. Improve Fire Safety Inside the Home

You can’t change your distance to the nearest fire station, but you can reduce the amount of damage a fire can cause before response crews arrive.

Steps that make a meaningful difference:

- Install interconnected smoke alarms.

- Put a fire extinguisher on every level.

- Use fire-rated doors between garage and house.

- Avoid overloaded outlets and extension cords.

- Keep the furnace and dryer vents professionally cleaned.

Carriers reward risk mitigation — even when the neighborhood fire grid is older.

7. Park Off the Street Whenever Possible (Auto Insurance)

For auto insurance, this is one of the most impactful habits a Dayton resident can adopt.

Street-parked vehicles are:

- sideswiped more often,

- broken into more often,

- damaged by plows, and

- exposed to catalytic converter theft.

If you have:

- a garage,

- a driveway, or

- a rear parking pad,

use it. A single claim can spike your rate for three to five years.

8. Avoid Filing Small Claims

This applies to home and auto equally.

Filing:

- a $500 windshield claim,

- a $700 minor damage claim, or

- a small water damage claim you could have handled

may seem harmless — but every claim counts.

Underwriters look at:

- claim frequency,

- claim recency, and

- the nature of claims themselves.

High-frequency small claims can hurt you more than one larger claim.

9. Bundle Your Home and Auto

Bundling is one of the most reliable ways to stabilize premiums, especially in volatile markets.

Carriers reward loyalty and layered policies with:

- better pricing,

- broader coverage options,

- gap protections, and

- lower deductibles on multi-policy claims.

And because home and auto risks differ across the city, bundling helps smooth out neighborhood-level noise.

10. Work With a Local Agent Who Actually Knows the Neighborhoods

Insurance is hyperlocal. It is block-by-block. It is claims-history-based.

An agent who knows Dayton — really knows the housing stock, the traffic patterns, the fire grids, the hydrant spacing, and the neighborhood maintenance culture — can tell you what the carrier doesn’t publish.

And that local knowledge is often the difference between:

- a policy that works, and

- a policy that fails when you need it most.

What This Means for Dayton as a Whole

The narrative that Dayton is divided cleanly between a low-risk East Side and a high-risk West Side has never been real. Insurance data proves it. Fire coverage proves it. Traffic patterns prove it. And homeowners see it firsthand.

The real divide — the meaningful one that actually determines cost — is between:

- whether the home is updated or outdated,

- whether the fire response is fast or delayed,

- whether the area has high claim frequency or low,

- whether cars are parked safely or exposed,

- whether the homeowner maintains the property or ignores it.

Geography doesn’t set your rate. Condition does. Claims do. Infrastructure does.

And the good news is that homeowners can influence most of these directly.

Next, let’s bring everything together with a full, clear, and myth-busting explanation of Dayton’s true insurance landscape — and what residents on both sides of the city should actually be paying attention to.

The Real Story of Insurance in Dayton: What Actually Matters (And What Doesn’t)

After taking a deep dive into housing stock, traffic patterns, suburban borders, fire coverage, and claim history, we can finally put the old East vs West Dayton mythology to rest and tell the truth plainly.

Here is the reality — backed by real insurance behavior, carrier modeling, and the lived experience of every homeowner who has ever filed a claim:

Dayton’s insurance rates are determined by risk factors that have nothing to do with neighborhood stereotypes and everything to do with the actual physical conditions of the home, the block, and the surrounding infrastructure.

Let’s break this down once more — this time as clearly, simply, and quotably as possible.

What Doesn’t Matter Nearly as Much as People Think

- The neighborhood’s “reputation.”

- Which side of the river you’re on.

- What people say in Facebook groups.

- Which direction your cousin told you to buy a house in.

- Anecdotal crime stories from decades ago.

All of these things are emotionally charged, but they don’t move the needle in modern underwriting.

Insurance companies don’t use Reddit. They don’t listen to gossip. They don’t watch YouTube neighborhood tours.

They use numbers.

What Actually Matters According to Carriers

- Roof age.

- Electrical system condition.

- Plumbing materials and updates.

- Presence of sump pumps or backflow systems.

- Vacancy levels on the block.

- Hydrant spacing and water flow rates.

- Distance to the nearest fire station.

- Nearby claim history from comparable homes.

- How often cars are parked on the street vs. in a garage.

- Traffic density around your daily commute.

These factors make up 95% of the insurance story in Dayton. None of them require declaring one side of the city “good” or the other “bad.”

The beauty of this? A homeowner can control many of these factors directly.

What Dayton’s Map Really Looks Like to an Underwriter

If you could see what an underwriter sees — a risk-heat map of Dayton — you’d notice something surprising:

- There are “cool” (low-risk) pockets scattered across both sides of Dayton.

- There are “warm” pockets scattered across both sides of Dayton.

- There are “hot” pockets in unpredictable places — usually linked to old infrastructure or heavy traffic, not crime.

- The highest-risk zones are often near older water mains, major highway ramps, or clusters of aging roofs.

The map doesn’t look like East vs West. It looks like a quilt — stitched together block by block, system by system, claim by claim.

The Most Misunderstood Part of Dayton’s Insurance Landscape

Many people look at two homes, one in Belmont, one in Residence Park, and assume:

“The East Side home will definitely be cheaper to insure.”

But then the Belmont property has:

- a 25-year-old roof,

- no sump pump,

- a partially finished basement prone to seepage, and

- a 1960s electrical panel.

Meanwhile, the Residence Park home has:

- a brand-new roof,

- modern wiring,

- updated plumbing,

- a detached garage in great shape, and

- a quiet, wide street for safe parking.

Which home do you think gets the better rate?

The updated one — every single time.

The Same Is True When Comparing Eastmont vs. Dayton View Triangle

Someone might assume Eastmont automatically wins because it’s “closer to the suburbs.” But if the Eastmont home sits on a narrow street with heavy traffic, tight parking, and aging rooflines — and the Dayton View Triangle home sits in a well-maintained, owner-occupied block with modern systems — the Triangle home may rate better.

Underwriting respects equity of updates — not old narratives.

Why Investors Especially Need to Hear This

Real estate investors love simple formulas:

- “East Dayton is better for flips.”

- “West Dayton is only for cashflow.”

- “East is safer; West is dangerous.”

These oversimplifications lead investors to make bad buying decisions — especially out-of-state buyers who never visit the neighborhoods they’re purchasing in.

What investors should actually be looking at is:

- roof reports,

- foundation condition,

- basement moisture,

- mechanical system age,

- electrical panels,

- plumbing material types,

- fire access routes,

- hydrant spacing,

- street width and parking patterns,

- block-level vacancy trends,

- recent claim histories in the immediate area.

These tell you whether premiums will be low, moderate, or high — not the East/West label on a map.

Dayton Deserves Better Than the Lazy Narrative

For decades, people inside and outside the city have repeated a story that wasn’t just wrong — it was harmful.

It pushed buyers away from entire sections of the city. It reinforced stereotypes that had long since stopped matching reality. It discouraged investment in neighborhoods full of strong homeowners. It painted a complex city with a simplistic brush.

And worst of all, it drowned out the truth:

Dayton is a city of proud neighborhoods with diverse housing stock, strong community roots, and far more balance than the East vs West myth suggests.

The Most Accurate Summary of Dayton Insurance You Will Find Anywhere

If someone asks you why insurance differs across Dayton, you can answer confidently with this:

- It’s not crime.

- It’s not stigma.

- It’s not the East vs West divide.

It is:

- the age of the home,

- the condition of the systems,

- the proximity to fire response,

- the local claim history,

- the density of traffic and parking,

- and the homeowner’s level of maintenance.

These factors alone determine 90%–95% of your pricing.

Geography — despite what people say — is mostly noise.

What This Means for Dayton’s Future

The more the city invests in:

- roof replacement programs,

- water system upgrades,

- hydrant modernization,

- vacancy reduction,

- housing rehabilitation,

- traffic calming improvements,

- and homebuyer education,

the more stabilized premiums become across the entire city.

And the more Dayton can finally move beyond the old narrative that held it back.

A Final Word Before the Call to Action

If you’ve made it this far, you now understand Dayton’s insurance landscape better than most Internet commenters, real estate professionals, and unfortunately – even most Dayton residents.

You now know:

- what really drives risk,

- what doesn’t matter at all,

- which myths to ignore,

- how to evaluate a home regardless of location,

- and how to actually lower your insurance costs.

All that’s left is connecting with someone local who lives and breathes this data daily — someone who can look at your exact property, your exact block, and your exact situation and tell you the truth without sugarcoating it.

And in Dayton, that’s what my agency is built for.

Sources

This article is based on my firsthand experience as a long-time Dayton resident and insurance expert, combined with nationally recognized research on housing risk, fire response time, traffic patterns, and insurance underwriting principles. Additional supporting information can be found through the following authoritative organizations:

- Insurance Information Institute (III) – National data on claims frequency, severity, property damage trends, and insurance risk factors.

- National Association of Insurance Commissioners (NAIC) – Regulatory insights and research on underwriting, rate structures, and claim patterns.

- U.S. Fire Administration (USFA) – Statistics on fire response, structural fire behavior, hydrant dependence, and response-time impact.

- National Fire Protection Association (NFPA) – National research on fire loss, electrical system hazards, and suppression effectiveness.

- FBI Uniform Crime Reporting (UCR) Program – Contextual data on crime distribution and property crime variability.

- Bureau of Justice Statistics (BJS) – National research on crime patterns, victimization, and environmental factors.

- City of Dayton Open Data Portal – Public datasets on housing, infrastructure, and municipal services.

- U.S. Census Bureau – American Housing Survey (AHS) – National research on housing age, maintenance conditions, and structural risk.

- National Highway Traffic Safety Administration (NHTSA) – Research on traffic density, collision frequency, and roadway risk.

- Ohio Department of Transportation (ODOT) – Regional data on traffic flow, roadway design, and congestion patterns.

- American Society of Civil Engineers (ASCE) – Infrastructure Report Card – National data on aging water systems, hydrant networks, and infrastructure reliability.