Electricians in Walnut Hills, Dayton: Liability and Tools Coverage Explained

Electricians in Walnut Hills, Dayton, encounter a distinct set of insurance considerations shaped by the neighborhood’s historic housing stock, dense tree canopy, and vibrant community lifestyle. From rewiring century-old homes to navigating detached garages and alley access, the risks faced here extend well beyond typical contractor hazards. A nuanced understanding of how liability insurance and tools coverage apply within this context is crucial—not only to safeguard the electrician’s business operations but also to support clients in preserving the architectural charm and safety of Walnut Hills residences. This article explores these insurance themes in depth, offering practical examples, detailed explanations, and localized insights, thereby providing a comprehensive resource for both electricians and property owners in the area.

Meet Walnut Hills, Dayton Ohio

Walnut Hills stands out as a distinctive Dayton neighborhood, rich in history and notable architectural character. The housing stock primarily includes early 1900s through mid-century residences, many featuring classic brick facades and inviting front porches. These properties have benefited from ongoing reinvestment and restoration efforts, reflecting a community that actively values its heritage while adapting to contemporary living standards. The streets are highly walkable and lined with mature trees that create a dense canopy, enhancing the neighborhood’s aesthetic appeal but also introducing seasonal risks such as storm damage and falling branches.

Most homes in Walnut Hills feature detached garages accessible via narrow alleys, a practical design element that significantly influences how contractors like electricians plan and execute their projects, especially when transporting tools and equipment. Basements are common in these homes, often presenting moderate moisture concerns due to local soil composition and drainage characteristics, necessitating frequent attention to electrical safety in these spaces. The neighborhood’s proximity to areas such as Twin Towers and Linden Heights contributes to a shared architectural language and similar infrastructure challenges. Living and working in Walnut Hills requires engagement with a community that balances historic charm with the realities of aging structures and evolving safety codes.

For contractors, particularly electricians, this environment means that understanding specific risks related to older wiring systems, roof access, and property layouts is critical. These factors influence the types of insurance coverage necessary and the strategies employed to mitigate risk on each job site. Homeowners and landlords similarly benefit from awareness of these conditions when selecting professionals and assessing insurance needs.

For a more comprehensive exploration of property protection in Walnut Hills, consider consulting our full Walnut Hills insurance guide.

How the Built Environment in Walnut Hills Shapes Insurance Risk

The physical environment of Walnut Hills directly shapes the liability and tools coverage challenges electricians face. The age and construction of many homes—often exceeding 70 years—mean that electrical systems frequently require updating or complete rewiring. These older residences may still contain knob-and-tube wiring or early mid-century electrical installations that do not meet current building codes, increasing the likelihood of electrical faults, fires, or system failures. When electricians undertake work on such legacy systems, the probability of accidental damage or the triggering of latent defects is significantly elevated compared to new construction projects.

The neighborhood’s dense tree canopy, while visually striking, introduces additional risk variables. Seasonal storms often cause falling limbs that can damage roofs, electrical lines, or outdoor lighting installations. For electricians, this translates not only into additional repair or upgrade work following weather events but also exposure to hazards while working on ladders or roofs adjacent to weakened tree limbs. These conditions highlight the critical importance of liability insurance coverage that comprehensively addresses property damage and bodily injury risks arising from environmental factors.

Detached garages accessed via alleyways further complicate logistics. Electricians must transport valuable and often heavy tools through narrow alleys with limited parking options. This setting heightens the risk of theft, loss, or damage to equipment, making tools coverage or inland marine insurance essential. Moreover, the presence of basements with moderate moisture levels requires electricians to exercise caution with potential water exposure risks, which can damage electrical components or tools and potentially increase liability if their work inadvertently exacerbates moisture issues or fosters mold development.

In essence, the interplay between Walnut Hills’ historic homes, natural surroundings, and infrastructure layout creates a multifaceted risk profile. Contractors must recognize how these factors amplify the stakes for property damage, personal injury, and tool loss, informing more strategic insurance purchasing decisions and safer job site practices.

Key Insurance Risks for Contractor Insurance in Walnut Hills

Contractor insurance for electricians in Walnut Hills must comprehensively address a spectrum of risks shaped by the local environment and typical job demands. The following elaborates on some of the principal exposures encountered, providing detailed explanations and relevant examples:

1. General Liability Risks: General liability insurance serves to protect electricians from claims arising due to bodily injury or property damage connected to their work. In Walnut Hills, these risks often manifest as accidental damage to historic home features—for instance, inadvertently harming original woodwork or plaster walls during wiring installation can result in costly claims, as restoring such historic elements often requires specialized craftsmanship. Additionally, the neighborhood’s walkable streets and close-knit community mean pedestrians and neighbors are frequently nearby, increasing the risk of injury claims if tools are dropped or trip hazards are created on porches or sidewalks. Lastly, property damage from electrical faults—such as fires or short circuits caused by improper wiring or testing—can extend beyond the immediate property, affecting adjacent homes.

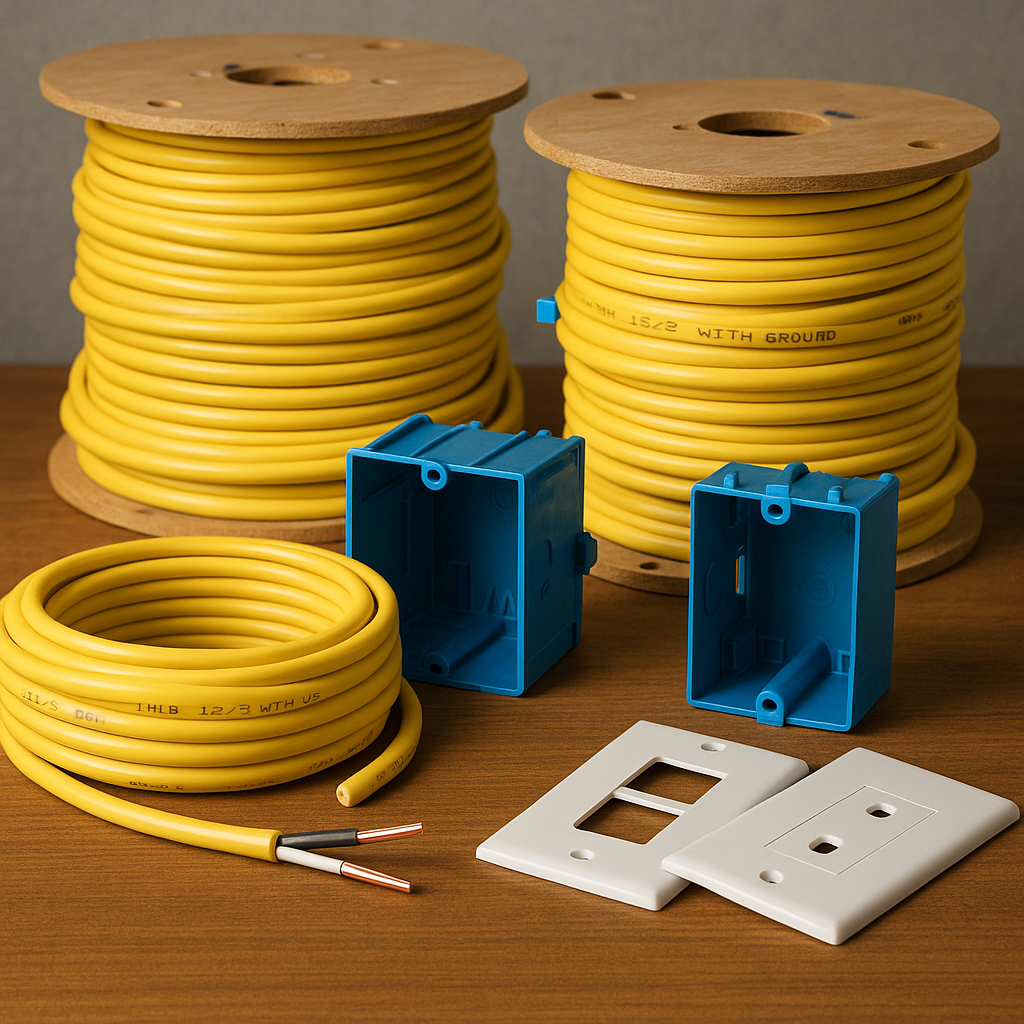

2. Tools and Equipment Coverage: The financial investment in electrical tools is substantial, and coverage must protect against multiple risks. Theft is a significant concern, as tools may be stolen from vehicles parked in alleyways or homes with limited security. Tools are also vulnerable to damage from weather exposure, accidental drops, or electrical malfunctions. Furthermore, the challenges of navigating Walnut Hills’ narrow alleys and streets increase the chances of accidental damage during transport, emphasizing the necessity for comprehensive tools insurance.

3. Inland Marine Insurance: This specialized coverage protects tools and equipment while in transit or stored off-site. Given Walnut Hills’ prevalence of detached garages and alley access, inland marine insurance extends protection beyond the immediate job site, covering tools during transport or temporary storage, which is essential in this neighborhood.

4. Workers’ Compensation: For electricians who employ helpers or subcontractors, workers’ compensation coverage is mandatory under Ohio law and critical for covering medical expenses and lost wages should work-related injuries occur. Working conditions in Walnut Hills, such as on older roofs or within damp basements, elevate the risk of injury, underscoring the importance of adequate workers’ comp protection.

5. Commercial Auto Insurance: Many electricians rely on vans or trucks to transport personnel and equipment. These vehicles face unique risks due to Dayton’s weather conditions, narrow alleys, and limited parking availability. Proper commercial auto insurance guards against accidents, theft, and liability claims associated with business vehicles, ensuring comprehensive protection.

6. Contractual Risks and Certificates of Insurance: Electricians frequently work as subcontractors on larger renovation projects, often requiring specific insurance limits and certificates of insurance to demonstrate compliance to general contractors or property owners. Failure to provide adequate proof of coverage can result in lost business opportunities or legal liabilities.

Understanding these risks is fundamental to aligning insurance coverage with the realities of daily hazards. For electricians in Walnut Hills, the unique combination of historic properties, local weather patterns, and neighborhood configuration means that generic contractor policies may either inadequately cover essential risks or include unnecessary provisions, leading to inefficiencies or coverage gaps.

How Contractor Insurance Works in Ohio (And What’s Different in Walnut Hills)

Contractor insurance in Ohio functions within the state’s regulatory framework but requires customization to reflect local conditions and business practices. At its core, contractor insurance packages multiple coverages designed to protect against financial losses arising from accidents, injuries, property damage, and equipment theft or loss. The following elucidates key coverages and the ways Walnut Hills’ context influences their application:

General Liability Insurance: This coverage addresses third-party claims related to bodily injury or property damage. Ohio’s standard policies often provide $1 million per occurrence with $2 million aggregate limits, but electricians in Walnut Hills should consider higher limits due to the elevated value and sensitivity of historic homes and the potential magnitude of claims. For example, a significant fire triggered by faulty wiring in a Walnut Hills home could easily surpass baseline limits once restoration and liability settlements are combined.

Tools and Equipment Coverage: Often embedded within general liability policies or offered as separate inland marine endorsements, this coverage protects against theft, loss, or damage to hand tools, power tools, and larger equipment. In Walnut Hills, the reliance on detached garages, alley parking, and frequent job site changes heightens the importance of inland marine coverage. Contractors should carefully review policy sublimits and deductibles to ensure adequate protection.

Workers’ Compensation: Ohio mandates workers’ compensation for most employers, but coverage details matter significantly. The risks of ladder falls, electrical shocks, and repetitive strain injuries are heightened in Walnut Hills due to older building structures and varied working conditions. Accurate employee classification and payroll documentation are essential to avoid premium penalties or claim denials.

Commercial Auto Insurance: Business vehicles require commercial auto policies, which provide broader coverage and liability protection than personal auto insurance. Walnut Hills’ narrow streets and alleys increase the probability of accidents, so contractors should assess coverage limits and consider endorsements such as hired/non-owned auto insurance to address all exposures.

Contractual Obligations: Many electricians subcontract on larger projects or work directly with property owners who demand certificates of insurance with specified limits and endorsements. Meeting these requirements is practically indispensable in Walnut Hills, where renovation is prevalent. Agents can assist in securing customized endorsements, such as additional insured status, to satisfy client demands.

Neighborhood Nuances: The historic fabric of Walnut Hills homes means that even minor errors can trigger expensive repairs beyond standard property damage, such as restoring period-specific moldings or sourcing rare materials. This reality amplifies liability exposure and underscores the necessity for comprehensive coverage. Additionally, the neighborhood’s susceptibility to seasonal storms increases the frequency of emergency callouts, exposing electricians to unpredictable working conditions and associated risks.

Understanding these insurance mechanisms enables electricians to balance adequate protection with cost control, ensuring they are equipped to respond confidently to claims and sustain long-term business viability within the Walnut Hills environment.

Coverage Decisions Walnut Hills Residents Can’t Afford to Get Wrong

Choosing Adequate Liability Limits

Liability limits specify the maximum amount an insurer will pay for a covered claim. While Ohio’s minimum requirements establish a baseline, electricians in Walnut Hills must carefully evaluate their exposure. For instance, a wiring error that causes a fire in a century-old home could result in property damage claims approaching $500,000, not including potential injury claims if residents or visitors are harmed. Selecting limits of at least $1 million per occurrence with $2 million aggregate is prudent, though larger projects or client contracts may necessitate higher limits.

Consider a hypothetical scenario: if a contractor carries only the state minimum liability limit of $100,000 and causes a $400,000 fire loss, they would be personally liable for the $300,000 shortfall, risking financial insolvency or asset forfeiture. Higher limits transfer this risk to the insurer, providing critical financial security and peace of mind.

Tools and Equipment Coverage vs. Self-Insurance

Electricians often deliberate between self-insuring their tools or purchasing dedicated coverage. In Walnut Hills, the risk of theft—especially from alley parking—or damage during transport can lead to significant financial loss. A $10,000 toolkit stolen overnight can halt operations for extended periods. Tools insurance generally reimburses replacement costs minus the deductible, enabling business continuity.

Premiums for tools coverage can be managed by selecting appropriate deductibles and limiting coverage to essential tools. Contractors who secure tools in locked vehicles or garages and maintain thorough inventories may negotiate more favorable rates. Inland marine policies provide flexible geographic coverage, advantageous for electricians servicing Walnut Hills and adjacent neighborhoods.

Workers’ Compensation: Protecting Your Team and Your Business

Beyond regulatory compliance, workers’ compensation safeguards both employees and contractors’ financial health. In Walnut Hills, hazards such as ladder falls on uneven porches, electrical shocks in damp basements, and musculoskeletal injuries from carrying equipment up stairs are prevalent. Underreporting payroll or misclassifying workers can lead to audits, back premium charges, and potential claim denials. Insufficient coverage exposes contractors to costly lawsuits stemming from workplace injuries.

Contractors should meticulously document work activities and payroll to ensure comprehensive coverage. Implementing safety training and providing appropriate equipment reduce the frequency of claims and contribute to premium stabilization over time.

Contractual Insurance Requirements and Certificates

Many renovation projects in Walnut Hills stipulate that electricians provide proof of insurance with specific limits and endorsements. Failure to comply can result in lost contracts or legal conflicts. Contractors should collaborate closely with their insurance agents to understand client requirements and obtain certificates of insurance promptly. Additionally, including general contractors as additional insureds offers protection against liability claims arising from subcontracted work, enhancing contractual compliance and business relationships.

Real-World Scenarios From Walnut Hills Streets and Homes

Scenario 1: Emergency Rewiring After Storm Damage

After a late spring storm, a Walnut Hills homeowner discovers that a fallen tree limb partially damaged the century-old home’s electrical system. An electrician is called for emergency rewiring. During the repair, a tool is accidentally dropped through a weakened porch floor, damaging the homeowner’s hardwood flooring and creating a trip hazard for a visiting guest.

In this case, general liability insurance covers the costs associated with property damage and any injury claims if the guest sustains harm. Tools coverage reimburses the electrician for the damaged equipment. Workers’ compensation protects the electrician if injured while working on the unstable porch. This layered coverage approach prevents financial losses from multiple sources and facilitates a swift resolution.

Scenario 2: Theft of Tools from Alley Parking

An electrician parks their van overnight in a Walnut Hills alley during a multi-day project. Despite securing the vehicle, a thief breaks in and steals $7,500 worth of power tools. Without tools coverage or inland marine insurance, the electrician must bear replacement costs personally and may face project delays.

Possessing inland marine insurance tailored for tools in transit would cover such theft, less the deductible, enabling prompt equipment replacement and adherence to project timelines. This example illustrates the critical importance of protecting tools within Walnut Hills’ unique setting, characterized by alleys and detached garages.

Scenario 3: Subcontracting on a Historic Home Renovation

A general contractor hires a local electrician as a subcontractor for a full-house rewiring of a 1920s Walnut Hills home. The contract requires $2 million liability limits and additional insured status. During the project, a mishandled wire causes a minor electrical fire that damages sections of the ceiling and wall finishes, both requiring specialist restoration.

The electrician’s general liability policy, meeting the required limits, covers damage costs and legal fees. The additional insured endorsement protects the general contractor from direct claims. This scenario underscores the importance of understanding contractual insurance obligations and securing appropriate endorsements to maintain professional relationships and mitigate financial exposure.

Cost, Discounts, and Smart Ways to Control Premiums

Cost considerations are pivotal when electricians select contractor insurance, yet balancing affordability with sufficient protection is essential. The following strategies can optimize premiums without compromising coverage:

Accurate Risk Assessment: Insurers base premiums on perceived risk. Demonstrating robust safety protocols, utilizing quality tools, and maintaining a clean claims history and good credit can reduce premiums.

Appropriate Coverage Limits: Selecting limits aligned with actual exposure avoids over-insurance. For example, million-dollar liability limits may be unnecessary for small, low-risk jobs, but are justified for historic home projects in Walnut Hills.

Deductible Selection: Higher deductibles lower premium costs but increase out-of-pocket expenses in the event of claims. Contractors with healthy cash flow might opt for elevated deductibles to achieve savings.

Bundling Policies: Combining coverages such as general liability, tools insurance, commercial auto, and workers’ compensation through a single insurer or agent often yields multi-policy discounts.

Seasonal and Usage Considerations: Adjusting policies to reflect seasonal work volume or employing pay-as-you-go workers’ compensation and tools coverage can optimize costs.

Local Expertise: Partnering with an agent knowledgeable about Walnut Hills ensures coverage tailored to neighborhood-specific risks, preventing unnecessary costs or coverage gaps.

Nearby Neighborhoods and How They Compare

Compared to these adjacent neighborhoods, Walnut Hills’ blend of older homes, dense tree coverage, and alley access shapes a unique contractor insurance profile. While Linden Heights shares similar architectural styles, its differing topography may present alternate moisture or storm risks. Twin Towers, known for its own historic charm, also demands careful liability management, though utility work there may involve distinct infrastructure challenges. Recognizing these nuanced differences equips electricians and property owners in Walnut Hills to make more informed and locally appropriate insurance decisions.

When and How to Review Your Policy if You Live or Own Property in Walnut Hills

Regularly reviewing contractor insurance policies is essential to ensure that coverage remains aligned with evolving risks and business operations. Electricians serving Walnut Hills should consider the following practical measures:

- Annual Review: Conduct comprehensive reviews of coverage limits, exclusions, and endorsements at least yearly. This process should include verifying that tools inventories are current and payroll data for workers’ compensation is accurate.

- After Major Projects: Following large or complex renovations—such as full rewiring of historic homes—reassess coverage to confirm that limits and certificates meet contractual obligations.

- Following Claims: After any insurance claim, review policy details with your agent to understand impacts on premiums and coverage, and adjust risk management procedures accordingly.

- Changes in Business Operations: When adding employees, acquiring new equipment, or expanding service areas, promptly update your insurer to prevent coverage gaps.

- Seasonal Adjustments: Some contractors modify coverage seasonally or based on workload fluctuations; discuss such adjustments with your agent when applicable.

Maintaining a checklist encompassing liability limits, tools coverage, workers’ compensation details, commercial auto policies, and certificate of insurance requirements helps ensure comprehensive oversight. Local insurance experts can assist in interpreting policy language and recommending updates tailored to Walnut Hills’ distinct environment.

Working With a Local Independent Agent Who Knows Walnut Hills

Partnering with an insurance agency deeply familiar with Walnut Hills’ unique character, risks, and contractor requirements is invaluable. Ingram Insurance, located at 733 Salem Ave, Dayton, OH 45406, specializes in customized contractor insurance solutions designed to address the complexities of historic homes and the active community within Walnut Hills. Our extensive knowledge of local construction practices, neighborhood-specific risks, and Ohio insurance regulations enables us to guide electricians in selecting and tailoring policies effectively.

We assist with:

- Assessing liability exposures specific to Walnut Hills projects

- Designing tools and inland marine coverage to protect valuable equipment

- Clarifying workers’ compensation obligations and identifying cost-saving opportunities

- Providing certificates of insurance and endorsements to satisfy client contractual requirements

- Offering ongoing support for policy reviews and updates as business needs evolve

Our local presence ensures accessibility, responsiveness, and a vested interest in the success of electricians and contractors serving Walnut Hills and nearby neighborhoods. For more information about insurance in Walnut Hills and strategies to protect your contracting business, contact us directly.

Ingram Insurance is based here in Dayton, serving homeowners, landlords, drivers, and business owners throughout Walnut Hills. For a second opinion on your coverage or a fresh quote, call (937) 741-5100, email contact@insuredbyingram.com, or visit https://www.insuredbyingram.com/ to get started.

Electricians and contractors seeking a broader understanding of property insurance in Walnut Hills may find our Walnut Hills homeowners insurance overview a valuable complementary resource to inform their contractor insurance planning.