Accident Prevention for Commuters in Edgemont, Dayton – 2026 Insurance Guide to Avoid Costly Mistakes

Edgemont, a historic neighborhood situated just northwest of downtown Dayton, Ohio, presents residents with a distinctive blend of early 20th-century architectural charm and strategic urban connectivity. For the multitude of commuters navigating its streets daily, a nuanced understanding of the neighborhood’s unique traffic dynamics, parking constraints, and seasonal weather influences is essential—not only for safe and effective driving but also for making well-informed auto insurance decisions. This article provides an in-depth analysis of how Edgemont’s physical and infrastructural characteristics shape accident risks and insurance considerations. It offers residents and property owners a comprehensive framework to mitigate accidents and optimize their coverage. Through exploration of local conditions, practical case studies, and the operational mechanics of Ohio auto insurance, we aim to empower thoughtful commuters with the knowledge to navigate Edgemont’s streets confidently and with clarity.

Meet Edgemont, Dayton Ohio

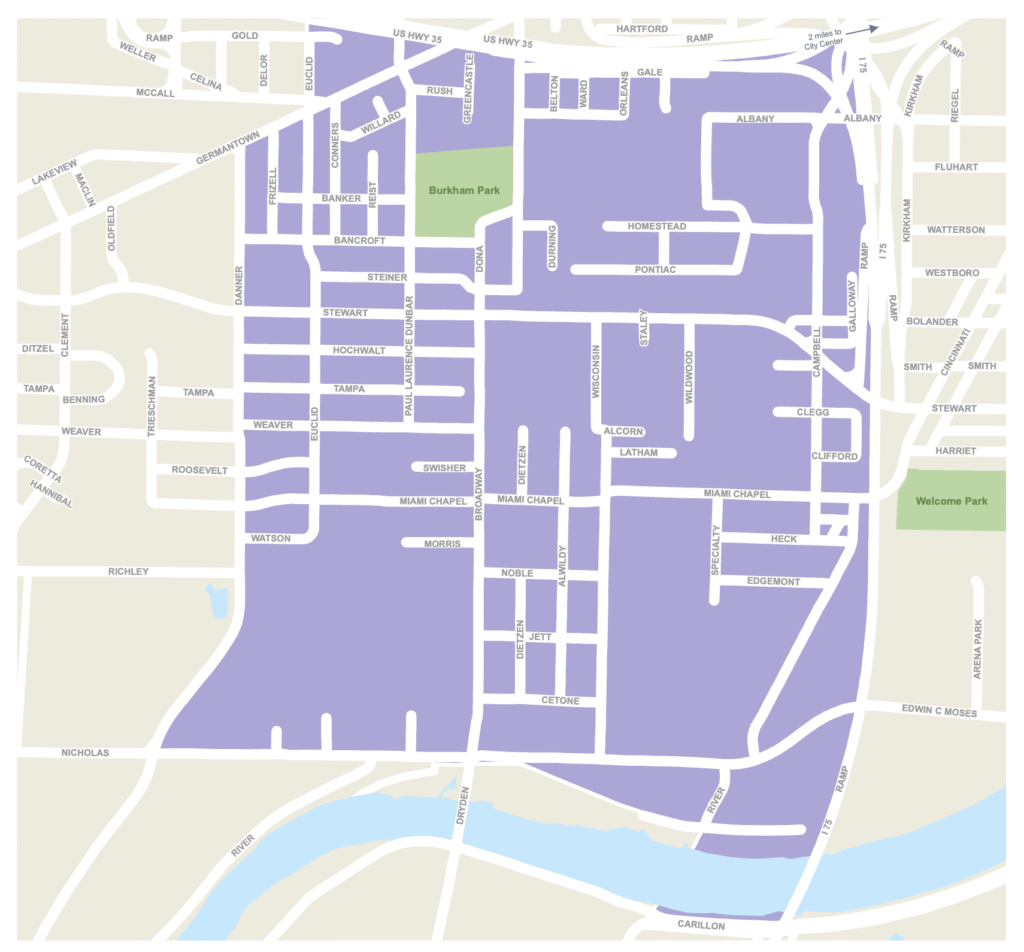

MEdgemont is distinguished by its housing stock primarily dating from the early 1900s through the 1940s, consisting largely of classic two-story residences and modest single-family homes that reflect its working-class heritage and enduring community fabric. While many properties have undergone selective renovations, the neighborhood retains older basements, aging drainage infrastructure, and a mature tree canopy—particularly prominent along the Wolf Creek corridor—which significantly influences both the ambiance and environmental conditions. The residential composition is mixed, with a combination of owner-occupied dwellings and investor-owned properties, contributing to a diverse and dynamic neighborhood rhythm. The streetscape itself, characterized by alleys, detached garages, and prevalent street parking, creates a unique environment that directly affects driving behavior and risk exposure.

Commuters residing in Edgemont benefit from the neighborhood’s immediate proximity to downtown Dayton, Miami Chapel, and adjacent communities, rendering it a strategic hub for daily travel. Nonetheless, the neighborhood’s infrastructure—comprising narrow residential streets, older parking layouts, and fluctuating traffic volumes—demands that drivers maintain heightened situational awareness. Furthermore, Dayton’s variable seasonal weather, including snowfall, rain, and occasional ice, introduces additional complexities to driving conditions. A comprehensive grasp of these interrelated factors is critical for effective accident prevention and for appreciating how insurance coverage responds to these localized realities.

For readers seeking a more extensive perspective on insurance matters pertinent to this area, please consult our detailed Edgemont insurance guide, which addresses both property and auto risks with greater specificity.

How the Built Environment in Edgemont Shapes Insurance Risk

The physical layout and characteristic features of Edgemont’s built environment exert a direct influence on the types and frequency of auto accidents as well as the nature of insurance claims filed by residents. The neighborhood’s streets, often narrow and lined with mature trees, incorporate older infrastructure elements such as alleys and detached garages, which are commonly utilized by residents for parking and vehicle access. These environmental attributes contribute to identifiable accident patterns and risk factors.

A prominent consideration is the prevalence of street parking, driven by limited garage availability and shared driveway configurations. This increases the likelihood of sideswipe collisions, “dooring” incidents—where a vehicle door is opened into the path of a passing vehicle or cyclist—and low-speed fender benders that typically occur in congested or confined spaces. The substantial tree canopy, especially along corridors adjacent to Wolf Creek, can obstruct sightlines, creating visibility challenges during critical times such as early morning or evening commutes when glare and shadows are more pronounced. This impairment to visibility can delay driver reaction times and elevate the risk of pedestrian conflicts.

Additionally, the network of older streets and alleys, which provide rear access to garages or secondary parking areas, tends to be narrow and sometimes suffers from inadequate maintenance. The absence of street lighting or clear signage in these alleys further increases the risk of low-speed collisions, including backing accidents. Given Edgemont’s proximity to downtown Dayton, major corridors often experience heavy traffic during rush hours, producing stop-and-go conditions that heighten the potential for rear-end collisions. The interaction of Dayton’s seasonal weather—comprising snow, ice, and frequent rain—with the neighborhood’s aging drainage systems exacerbates accident risks and complicates the claims process.

These environmental factors are not merely theoretical; they manifest in tangible insurance risks and claims scenarios. For example, a commuter attempting to back out of a narrow alley onto Salem Avenue may misjudge oncoming traffic due to obstructed visibility, resulting in a collision. Similarly, the combination of street parking and heavy morning traffic can lead to a series of low-speed, multi-vehicle fender benders, which test the robustness of one’s collision and liability coverage.

Key Insurance Risks for Auto Insurance in Edgemont

A comprehensive understanding of the specific auto insurance risks confronting Edgemont residents requires a layered analysis that recognizes how localized conditions amplify common driving hazards. Several risk categories warrant particular attention in this context:

1. Liability Exposure: Ohio’s Minimum vs. Recommended Limits

Ohio law mandates minimum auto liability coverage limits of 25/50/25, representing $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $25,000 for property damage. While these minimum thresholds comply with legal requirements, they frequently prove insufficient to cover damages arising from even moderately severe accidents within Edgemont or the wider Dayton area.

Consider, for instance, a situation wherein a driver causes a multi-vehicle collision on Salem Avenue during rush hour. The associated medical expenses for injured parties and vehicle repair costs can quickly surpass the statutory minimum limits. If the liability coverage is inadequate, the at-fault driver is personally liable for the shortfall, potentially incurring significant financial hardship. Consequently, many prudent Edgemont residents elect to carry higher liability limits—such as 100/300/100 or greater—to ensure protection of their personal assets against such exposures.

2. Comprehensive and Collision Coverage

Given Edgemont’s older housing stock and infrastructure, vehicles face hazards extending beyond collision incidents. The neighborhood’s substantial tree canopy, particularly near Wolf Creek, poses a risk of falling branches that can inflict notable damage. Moreover, street parking exposes vehicles to threats of vandalism, theft, and incidental damage caused by passing traffic.

Comprehensive coverage addresses these “non-collision” perils by providing protection against falling tree limbs during storms, hit-and-run damage occurring while vehicles are parked on the street, and weather-related damages including hail or localized flooding. Collision coverage, in contrast, compensates for repairs when the insured vehicle impacts another vehicle or object or is itself struck. Considering the predominance of tight alleys and narrow streets in Edgemont, collision coverage is particularly vital to safeguard against minor yet potentially costly scrapes and dents.

3. Uninsured and Underinsured Motorist Coverage

Despite Ohio’s mandatory insurance requirements, a significant proportion of drivers remain uninsured or underinsured. This risk is accentuated in urban neighborhoods like Edgemont, where socioeconomic diversity correlates with varying degrees of insurance compliance.

Uninsured Motorist (UM) coverage protects Edgemont drivers involved in accidents caused by drivers lacking insurance, while Underinsured Motorist (UIM) coverage provides a financial safety net when the at-fault party’s liability limits are insufficient to fully cover the insured’s damages. For example, a driver backing out of a driveway on Edgemont’s side streets could be struck by an uninsured motorist. Absent UM/UIM coverage, the victim’s own insurer would not cover injuries or damages exceeding personal health insurance provisions.

4. Medical Payments Coverage

Medical Payments (MedPay) coverage facilitates payment of medical expenses resulting from auto accidents, regardless of fault. In a neighborhood like Edgemont, where many older homes accommodate family members or visitors who depend on personal vehicles, MedPay serves as an important adjunct to health insurance by enabling expedited access to treatment funds without the delays associated with health insurance claims processing.

5. Endorsements and Additional Coverages Relevant to Edgemont

Certain endorsements can augment protection tailored specifically to Edgemont’s distinctive risk profile. Roadside Assistance coverage proves invaluable during Dayton’s winter months when weather-related vehicle breakdowns increase. Rental Reimbursement coverage supports commuters who rely heavily on their vehicles and cannot afford downtime following an accident. Accident Forgiveness protects policyholders against premium increases after a first at-fault accident, a feature particularly beneficial in a neighborhood where low-speed incidents are relatively common.

How Auto Insurance Works in Ohio (And What’s Different in Edgemont)

Ohio operates a fault-based auto insurance system, wherein the driver responsible for an accident bears liability for damages. State law requires minimum liability insurance, but coverage extent beyond these thresholds varies widely. Understanding how insurance mechanisms intersect with Edgemont’s local context is crucial for optimizing coverage decisions.

Insurance functions fundamentally as a risk transfer mechanism whereby drivers pay premiums in exchange for financial protection against potential losses. Insurers assess risk through multiple factors and set premiums reflective of claim likelihood and potential cost. In Edgemont, considerations such as traffic density, street design, parking practices, and weather patterns directly influence risk assessments.

For example, a driver who routinely parks on the street in Edgemont may incur higher premiums compared to one with access to a secured garage, due to elevated risks of theft or damage. Similarly, frequent commuting along the neighborhood’s congested corridors during peak hours increases collision risk scores. The insurance system incentivizes safer driving behaviors by rewarding clean records with lower premiums, while drivers with prior claims or violations face higher costs—thereby aligning financial incentives with accident prevention.

Ohio’s minimum liability limits establish a legal baseline but do not guarantee comprehensive financial protection. For instance, if a driver causes an accident resulting in $150,000 in damages but carries only $25,000 in liability coverage, they are personally liable for the $125,000 difference. This stark example underscores the necessity of carefully evaluating recommended limits within the context of Edgemont’s traffic and risk environment.

To appreciate how these principles operate in practice, it is important to consider the interplay between insurance policies, local conditions, and personal driving habits. For a more detailed examination of how Edgemont’s housing stock and neighborhood risks influence insurance choices, please refer to our Edgemont homeowners insurance overview.

Coverage Decisions Edgemont Residents Can’t Afford to Get Wrong

Choosing Adequate Liability Limits

Many drivers, aiming to reduce premium costs, elect to maintain Ohio’s minimum liability limits—a choice often considered a false economy. Although initial savings may appear attractive, the potential financial exposure resulting from serious accidents can far exceed these savings. Edgemont residents who regularly commute along busy routes, particularly during peak traffic hours, should strongly consider liability limits of at least 100/300/100 to provide a meaningful safety net.

To illustrate, a rear-end collision on Salem Avenue resulting in combined hospital and vehicle repair expenses of $120,000 would leave a driver with minimum coverage responsible for $95,000 out-of-pocket. Higher liability limits effectively mitigate this risk by covering a broader range of damages.

Deciding When to Maintain Comprehensive and Collision Coverage

Some drivers choose to drop comprehensive and collision coverage once their vehicle’s market value declines, perceiving that premium savings outweigh coverage benefits. In Edgemont, however, this decision can prove costly given the neighborhood’s specific risk factors.

Consider the likelihood of falling tree limbs, vandalism associated with street parking, and frequent low-speed collisions. Even for older vehicles, repair costs from these incidents can be substantial. Maintaining comprehensive and collision coverage until repair costs consistently fall well below deductibles is a prudent approach that aligns protection with neighborhood realities.

Investing in Uninsured/Underinsured Motorist Coverage

Due to Ohio’s uninsured driver prevalence and Edgemont’s urban setting, Uninsured/Underinsured Motorist (UM/UIM) coverage is essential. It bridges coverage gaps left by at-fault drivers lacking sufficient insurance, often at a cost lower than many anticipate while providing significant financial security.

Considering Medical Payments Coverage

While many rely primarily on health insurance for accident-related medical expenses, Medical Payments (MedPay) coverage offers a valuable supplement, enabling swift access to funds without deductibles or claim denials. This coverage is particularly advantageous for commuters transporting family members or participating in ride-sharing, providing an additional layer of financial protection and peace of mind.

Real-World (hypothetical) Scenarios From Edgemont Streets and Homes

Scenario 1: Alley Backing Collision

Mrs. Thompson, a long-standing Edgemont resident, parks her vehicle in a detached garage accessed via a narrow alley. One rainy morning, she backs out onto Salem Avenue during the morning rush hour. Due to limited visibility caused by dense tree cover and parked vehicles, she fails to see an approaching cyclist and collides with the rider.

Her liability insurance, maintained at Ohio’s minimum limits, covers only a portion of the cyclist’s medical expenses. The cyclist’s total costs exceed $40,000, resulting in Mrs. Thompson being personally liable for the uninsured balance. Had she opted for higher liability limits, this financial shortfall would have been significantly reduced or eliminated.

Scenario 2: Comprehensive Claim from Tree Limb Damage

Mr. Garcia regularly parks his vehicle on the street near the Wolf Creek corridor, appreciating the neighborhood’s mature tree canopy. During a spring storm, a heavy tree limb falls, shattering his windshield and causing substantial body damage. His comprehensive coverage addresses the $3,200 repair cost, less the applicable deductible.

If Mr. Garcia had elected to forgo comprehensive coverage to reduce premiums, he would have been responsible for the entire repair expense out-of-pocket. This example highlights how Edgemont’s environmental characteristics translate directly into tangible insurance benefits.

Scenario 3: Uninsured Motorist Hit-and-Run

Ms. Patel, a professional commuting daily from Edgemont to downtown Dayton, is struck by a hit-and-run driver while stopped at a traffic light on Salem Avenue. The at-fault party is never identified. Thanks to Ms. Patel’s uninsured motorist coverage, her medical costs and vehicle repairs are fully covered despite the absence of a responsible party.

This scenario exemplifies the critical importance of UM coverage in an urban neighborhood characterized by frequent pedestrian and vehicle traffic interactions.

Cost, Discounts, and Smart Ways to Control Premiums

Residents of Edgemont can effectively manage auto insurance expenses without compromising essential coverage by understanding tradeoffs and strategically utilizing available discounts. One common strategy involves bundling auto insurance with homeowners or renters insurance through a single provider such as Ingram Insurance, which often yields multi-policy discounts. Maintaining a clean driving record over multiple years qualifies drivers for safe driver discounts, which can significantly reduce premiums. Vehicles equipped with safety features such as anti-theft devices, backup cameras, and advanced driver assistance systems may also qualify for premium reductions.

In addition, some insurers offer usage-based programs employing telematics technology that reward low mileage or safe driving habits, a particularly suitable option for Edgemont commuters with predictable routes and schedules. Adjusting deductible levels offers another lever: selecting higher deductibles reduces premium costs but requires budgeting for larger out-of-pocket expenses in the event of a claim.

Balancing these factors with individual risk tolerance and driving patterns is critical. For example, choosing a higher deductible may be appropriate for a driver who parks in a secured garage and primarily operates on less congested streets but could introduce undue financial risk for those who frequently park on-street or navigate busy corridors.

Nearby Neighborhoods and How They Compare

Compared to Edgemont, these adjacent neighborhoods share similar characteristics such as older housing stock and urban infrastructure but exhibit distinct traffic patterns and parking configurations that influence their respective risk profiles. For example, Wolf Creek’s extensive tree canopy leads to a higher incidence of storm-related vehicle damage, underscoring the need for comprehensive coverage. Conversely, Miami Chapel features wider streets, which may reduce the frequency of low-speed collisions common in tighter urban environments. Recognizing these nuances assists Edgemont residents in contextualizing their own risks and insurance requirements within the broader Dayton metropolitan area.

When and How to Review Your Policy if You Live or Own Property in Edgemont

Regular review of your insurance policy is a fundamental component of effective risk management, especially in a dynamic neighborhood like Edgemont where environmental and infrastructural conditions can evolve. We recommend the following best practices and timing guidelines:

- Annual Review: At a minimum, conduct a comprehensive review of your auto insurance policy once per year to verify that coverage remains aligned with your current vehicle status, driving habits, and neighborhood conditions.

- After Major Life Changes: Significant events such as purchasing a new vehicle, relocating within or outside Edgemont, or experiencing changes in commute patterns warrant immediate policy reassessment and potential adjustments.

- Following Claims or Incidents: After any accident or insurance claim, it is prudent to review your coverage to determine whether deductibles, limits, or endorsements require modification to address newly identified vulnerabilities.

- Check for Discounts: Periodically inquire about existing and newly available discounts for which you might qualify, especially after installing safety equipment or completing defensive driving courses.

Edgemont’s unique environment means that seemingly minor changes—such as the installation of a new traffic control device, neighborhood construction projects, or shifting local weather trends—can influence risk levels. Maintaining an informed and proactive stance is your most effective defense against unforeseen exposures.

Working With a Local Independent Agent Who Knows Edgemont

Navigating the complexities of auto insurance in Edgemont necessitates localized expertise. Independent agents at Ingram Insurance possess intimate knowledge of the neighborhood’s traffic patterns, seasonal weather impacts, and the specific risks associated with its older housing stock and infrastructure. This localized insight ensures that your coverage is precisely tailored rather than generic, providing personalized recommendations that balance risk, affordability, and peace of mind.

An independent agent offers access to multiple insurance carriers and delivers impartial guidance on appropriate liability limits, comprehensive and collision coverage, and endorsements relevant to Edgemont’s distinct conditions. They also assist in avoiding frequent pitfalls such as underinsurance or the premature elimination of critical coverages.

If you seek a second opinion on your current coverage or wish to receive a fresh quote that reflects Edgemont’s realities, the team at Ingram Insurance stands ready to assist.

Ingram Insurance is locally based in Dayton and serves homeowners, landlords, drivers, and business owners throughout Edgemont. To request a consultation or obtain a quote, call (937) 741-5100, email contact@insuredbyingram.com, or visit https://www.insuredbyingram.com/.

Conclusion

Accident prevention for commuters in Edgemont extends beyond cautious driving practices; it encompasses a multifaceted challenge influenced by the neighborhood’s historic streets, parking realities, and seasonal weather patterns. A thorough understanding of these factors, coupled with knowledge of Ohio’s auto insurance framework, empowers residents to make informed decisions regarding adequate liability limits, maintenance of comprehensive and collision coverage, and protection through uninsured motorist policies. Thoughtful risk management, complemented by collaboration with a knowledgeable local independent agent, forms the cornerstone of safer daily commutes and financial security in this vibrant Dayton neighborhood.

For further information on insurance tailored to Edgemont or to explore personalized options, contact Ingram Insurance today. We take pride in serving as your local resource and advocate.