Home Insurance in Carillon: Key Factors for a Neighborhood on the Brink of Massive Appreciation

Carillon, a historic Dayton neighborhood nestled along the river corridor and adjacent to Carillon Park, is quietly on the cusp of significant real estate appreciation. Its charming mid-century homes, mature landscaping, and scenic streets offer residents a unique blend of urban convenience and serene living. However, these desirable attributes also bring distinctive insurance challenges that prudent homeowners must fully understand. Aging electrical systems, moisture intrusion risks linked to proximity to the Great Miami River, and elevated reconstruction costs driven by historic craftsmanship all contribute to a complex insurance landscape. Carillon’s housing stock, characterized by its architectural heritage and environmental context, demands a nuanced approach to home insurance. This article explores the interplay between Carillon’s built environment, localized risks, and insurance mechanics—equipping thoughtful residents with the knowledge to make informed, tailored coverage decisions for this special Dayton enclave.

Meet Carillon, Dayton Ohio

Carillon stands out in Dayton’s urban fabric as a neighborhood with a rich architectural heritage and lush natural features. Its housing stock predominantly consists of single-family homes constructed between the 1930s and 1960s. Many of these residences feature brick exteriors—a hallmark of mid-20th century craftsmanship—and are situated on larger-than-average lots when compared to other Dayton neighborhoods. The presence of mature trees and well-established landscaping not only enhances aesthetic appeal but also contributes to the tranquil streetscape that residents deeply value.

Architecturally, Carillon’s homes frequently present multi-level layouts and finished basements, reflecting mid-century design trends that emphasized both spaciousness and functional living areas. Interiors often retain original woodwork and custom windows, elements that significantly increase both the charm and replacement cost of these properties. Due to the retention of legacy plumbing materials and older electrical panels, the infrastructure of many homes requires meticulous maintenance and consideration from both an operational and insurance perspective.

Geographically, the neighborhood’s close proximity to the Great Miami River and its location within certain topographic depressions contribute to microclimates prone to moisture accumulation and drainage challenges. These environmental factors, combined with the historic nature of the housing stock, uniquely shape insurance considerations for Carillon residents.

Life in Carillon affords residents easy access to Carillon Park, a prominent hub for heritage tourism and community events, as well as the scenic riverfront bike path. The neighborhood’s quiet, verdant streets provide a peaceful residential experience within minutes of downtown Dayton, the University of Dayton, and Miami Valley Hospital. This blend of heritage, natural beauty, and urban convenience cultivates a community identity that is both deeply historic and forward-looking.

For those seeking a more comprehensive overview, our full Carillon insurance guide offers an in-depth exploration of the neighborhood’s specifics and insurance implications.

Why Carillon Is Poised for Appreciation

Carillon’s insurance profile cannot be separated from its emerging position in Dayton’s real estate market. The neighborhood sits at the intersection of several long-term demand drivers: its adjacency to the University of Dayton, the continuing investment in nearby healthcare infrastructure, and its immediate access to the Brown Street commercial corridor. These forces combine to increase both the desirability of the housing stock and the likelihood that replacement costs and market values will rise over time. For homeowners and investors, understanding these appreciation pressures is critical when determining coverage limits and planning for future insurability in a higher-value market.

University of Dayton Expansion and Housing Demand

The University of Dayton continues to exert a significant influence on neighborhoods surrounding its campus, and Carillon is no exception. As the university expands its academic programs, research footprint, and student population, demand for nearby housing naturally intensifies. Even when the institution develops its own student housing, the presence of faculty, staff, graduate students, and professionals working in university-adjacent roles creates sustained interest in well-located residential neighborhoods within a short commute of campus.

Carillon’s location just across the river corridor and within minutes of the main campus positions it as a compelling option for those seeking quieter, single-family living environments with convenient access to the University of Dayton. Over time, this demand tends to support higher sale prices, lower vacancy rates, and increased investment in property improvements. From an insurance standpoint, rising home values and upgraded interiors mean that dwelling limits must be reviewed regularly to keep pace with appreciation and renovation activity. Failing to adjust coverage as values rise can leave long-time owners underinsured, particularly if the neighborhood experiences a step-change in pricing due to institutional expansion.

Healthcare Investment: The 5 Rivers Health Center on Miami Chapel

Another important anchor near Carillon is the presence of the Five Rivers Health Centers facility at 721 Miami Chapel Road. Healthcare infrastructure tends to be a durable economic driver, attracting a steady flow of employees, patients, and supportive services to surrounding areas. The continued operation and potential expansion of such a facility adds stability to the local housing market by anchoring employment close to the neighborhood.

For Carillon, proximity to a significant healthcare employer increases the pool of prospective residents who value short commute times and access to medical services. Over the long term, this can contribute to gradual price appreciation and sustained property maintenance as more homeowners view the neighborhood as a long-term residence rather than a purely speculative investment. As with the influence of the University of Dayton, this dynamic underscores the need for insurance policies that reflect realistic reconstruction costs and account for future upgrades owners may undertake to keep properties competitive in an improving market.

Connectivity to Brown Street: Food, Amenities, and Urban Lifestyle Appeal

Carillon’s residential calm is balanced by its immediate access to Brown Street, one of Dayton’s most active corridors for restaurants, cafés, and everyday services. A short drive or bike ride connects residents to an array of dining options, nightlife, and retail amenities that serve both the University of Dayton community and the broader city. This combination of quiet, tree-lined streets at home and quick access to “food and fun” on Brown Street enhances Carillon’s appeal to a wide range of buyers, from young professionals and faculty to downsizing homeowners who still want urban conveniences close by.

Real estate markets typically reward neighborhoods that offer this blend of livability and accessibility. As more Dayton residents and newcomers recognize Carillon’s ability to deliver both, demand pressure is likely to translate into higher sale prices and more extensive home renovations. For insurers and policyholders, this anticipated appreciation reinforces the importance of using up-to-date replacement cost estimates, revisiting liability limits as foot and vehicle traffic nearby increases, and considering endorsements that protect upgraded interiors and exterior improvements made in response to a strengthening market.

How the Built Environment in Carillon Shapes Insurance Risk

The unique characteristics of Carillon’s built environment exert a direct influence on the risk profile that insurance underwriters assess when determining home insurance policy pricing and structure. A thorough understanding of these connections enables homeowners to appreciate why certain coverages or endorsements are particularly pertinent to this neighborhood.

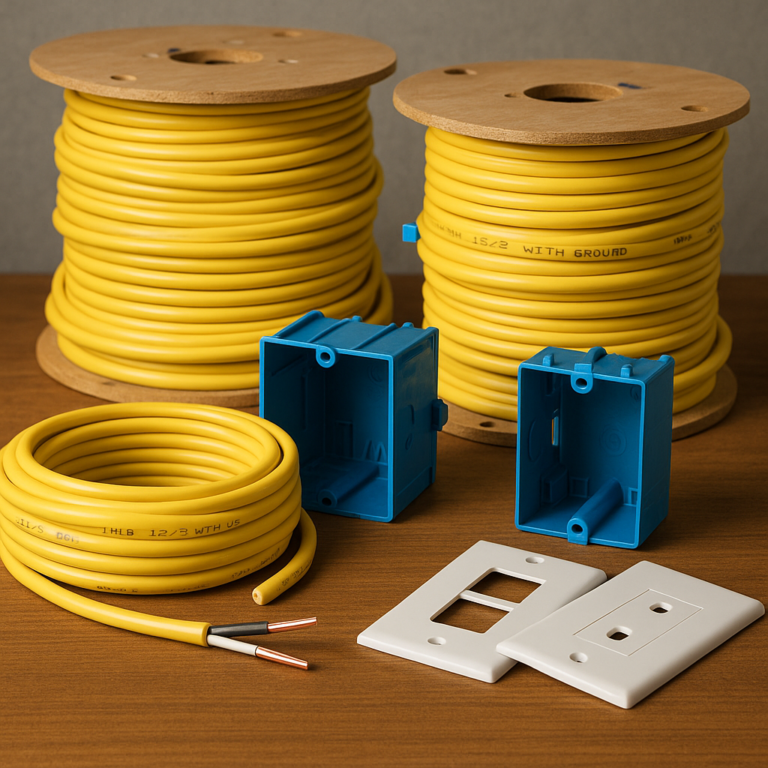

Housing Age and Construction Materials: Many homes in Carillon were constructed between the 1930s and 1960s, predominantly featuring brick exteriors and original framing materials. Brick construction offers notable durability and fire resistance, factors that can positively affect insurability. However, older homes often retain original electrical panels with outdated wiring configurations, as well as plumbing systems composed of galvanized steel or cast iron. These legacy systems are inherently more susceptible to failure and water damage, thereby elevating the likelihood of claims associated with plumbing leaks or electrical fires.

Basements and Drainage: Finished basements are a common feature in Carillon homes, adding valuable livable square footage but also introducing increased risk of water intrusion. Given Carillon’s proximity to the Great Miami River and its relatively low-lying topography, groundwater seepage and surface water drainage issues are frequent challenges. Homes lacking adequate foundation drainage systems or functional sump pumps are particularly vulnerable to mold development and structural damage, factors that increase repair costs and claims frequency.

Tree Coverage and Landscaping: Mature trees contribute significantly to Carillon’s cherished streetscape but also present notable hazards. Falling limbs or entire trees can cause substantial damage to roofs, siding, or windows during Ohio’s seasonal wind, ice, or storm events. Insurers routinely assess the density and health of surrounding trees during underwriting, which may influence premium levels or necessitate risk mitigation measures such as professional tree maintenance.

Historic Architectural Details: Carillon’s mid-century homes often exhibit custom wood trim, distinctive window styles, and oversized brickwork. While these architectural elements enhance visual appeal and historic authenticity, they also increase replacement costs if damaged. For instance, replacing a damaged custom window with modern, off-the-shelf alternatives may not satisfy homeowners or insurers intent on preserving historic character. This reality necessitates carefully calibrated coverage limits and consideration of ordinance or law endorsements to address potential increased rebuilding expenses.

Grasping how these aspects of the built environment impact insurance risk is essential for Carillon residents seeking customized and effective home insurance solutions. For a more detailed examination of insurance considerations across Dayton’s urban neighborhoods, readers can consult our Carillon homeowners insurance overview.

Key Insurance Risks for Home Insurance in Carillon

While standard home insurance policies cover a broad spectrum of potential losses, Carillon’s distinctive location and historic housing stock introduce specific risks that homeowners must evaluate with care.

Moisture and Water Intrusion: Due to the neighborhood’s adjacency to the river corridor and its position within low-lying areas, moisture challenges are persistent. Although FEMA flood maps may place some homes outside mandatory flood zones, localized flooding and basement seepage remain a tangible risk during periods of heavy rainfall or elevated river levels. Standard homeowners insurance policies exclude flood damage, making the acquisition of a separate flood insurance policy advisable for certain properties. Additionally, water backup resulting from sump pump failure or sewer line issues is a common concern, particularly given the age of many basements and drainage systems.

Older Mechanical Systems: Electrical panels and plumbing systems installed decades ago pose an increased risk of malfunction and subsequent property damage. For example, an outdated electrical panel may heighten the risk of fire due to circuit overload or faulty wiring. Similarly, corroded or brittle plumbing pipes can lead to sudden leaks, substantial water damage, and mold growth. Insurers incorporate these factors into underwriting processes through requirements for inspections, premium surcharges, or exclusions unless modernization upgrades are undertaken.

Tree and Storm Damage: The mature tree canopy that defines Carillon’s streetscape also means that wind or ice storms can cause falling limbs or entire trees to damage roofs, gutters, and siding. Homeowners with extensive tree coverage may face increased premiums or obligations to conduct routine tree maintenance to mitigate risk.

Replacement Cost vs. Market Value: The historic craftsmanship and custom elements characteristic of many Carillon homes mean that rebuilding costs following a total loss frequently exceed the home’s current market value. Replacement cost estimates often surpass sale prices, particularly when accounting for the need to match brickwork, custom windows, and trim. This disparity creates a heightened risk of underinsurance if coverage limits are set too low, potentially leaving homeowners responsible for substantial out-of-pocket expenses after a claim.

Liability Exposure from Park and Tourism Proximity: Carillon’s proximity to Carillon Park and public walkways increases pedestrian traffic near residential properties. This situation elevates liability risk for homeowners, as visitors may occasionally trespass or sustain injuries on private property adjacent to public spaces. Adequate liability coverage limits and the consideration of personal umbrella policies are essential to managing this exposure effectively.

How Home Insurance Functions in Ohio — And the Distinct Considerations in Carillon

While homeowners insurance policies across the United States share a common framework, the way coverage is applied in Ohio is shaped by state-specific regulations, regional weather patterns, and the characteristics of Dayton’s older housing stock. For Carillon residents, understanding these mechanics is essential to selecting coverage that appropriately reflects both neighborhood conditions and the realities of insuring mid-century homes.

Understanding the Insurance Model

At its foundation, homeowners insurance is built on a shared-risk model. Policyholders contribute premiums into a collective pool, and the insurer uses those funds to pay covered losses for events such as fire, theft, windstorms, or liability claims. Because each household’s risk profile differs—based on factors like home construction, maintenance, claims history, and geographic exposure—premiums vary accordingly. This system naturally encourages homeowners to reduce vulnerabilities through routine upkeep and system upgrades, since well-managed properties are less costly to insure.

The Major Components of an Ohio Homeowners Policy

Although policies differ by carrier, most include several core categories of protection:

- Dwelling Coverage: Pays for repairs or reconstruction of the home’s primary structure when damaged by covered events.

- Other Structures: Provides coverage for detached buildings such as garages, storage sheds, and fencing.

- Personal Property: Covers belongings inside the home, including furniture, electronics, and household goods.

- Liability Coverage: Protects the homeowner if someone is injured on their property or if the homeowner unintentionally damages another person’s property.

- Loss of Use / Additional Living Expenses: Helps pay for temporary housing and related expenses if the home becomes uninhabitable after a covered loss.

Replacement Cost vs. Actual Cash Value

A crucial distinction for Carillon homeowners concerns how insurers calculate payouts after a loss. Policies written with replacement cost coverage reimburse the cost to repair or rebuild using modern materials of similar quality, without deducting for age or wear. Actual cash value coverage, by contrast, depreciates items based on their condition and useful life. In a neighborhood filled with original trim, custom windows, and mid-century craftsmanship, relying on ACV can create major financial gaps. A unique architectural feature that costs thousands to reproduce today might receive only a fraction of that amount under an ACV settlement.

Why Carillon’s Location and Housing Stock Matter

Several neighborhood-specific factors influence how insurance carriers underwrite and price policies in Carillon:

- Flood and Surface Water Concerns: The proximity to the Great Miami River and the presence of low-lying pockets mean that surface water and groundwater intrusion remain real risks, even for properties outside FEMA’s mapped flood zones. Supplemental flood coverage should be evaluated carefully.

- Water Backup Endorsements: Many basements rely on sump pumps and older sewer connections. Because standard homeowners policies exclude damage from sewer or drain backups, most Carillon homes benefit from a water backup endorsement, which covers cleanup and property restoration after internal water failures.

- Ordinance or Law Coverage: Homes with historic features or older structural systems often face additional expenses when repairs must meet modern code standards. Ordinance or law coverage helps pay for these code-driven upgrades during reconstruction.

- Wind and Hail Deductibles: Ohio insurers often apply separate deductibles for wind-related events. Given Carillon’s mature trees and the periodic severity of regional storms, understanding how these deductibles function is essential to financial planning.

Because Carillon’s homes, terrain, and environmental exposures differ meaningfully from newer subdivisions, working with a Dayton-based independent agent familiar with the neighborhood’s nuances is the most effective way to ensure coverage aligns with both the property’s characteristics and its long-term appreciation potential.

Coverage Decisions Carillon Residents Can’t Afford to Get Wrong

Setting Adequate Dwelling Coverage Limits

One of the most consequential decisions for Carillon homeowners is accurately determining dwelling coverage limits. Underinsuring the home can result in severe financial hardship after a loss. Because Carillon’s homes often carry replacement costs that exceed market value due to historic trim, oversized brickwork, and custom windows, basing coverage limits solely on sale price is inadequate.

For example, a home listed for $200,000 might have a replacement cost closer to $280,000 once historic materials and specialized labor are accounted for. If the policy limit remains $200,000, the homeowner faces an $80,000 shortfall they must cover personally in the event of a total loss.

Engaging with an experienced local agent to obtain a professional replacement cost estimate or appraisal is highly advisable. Many insurance companies also perform detailed underwriting inspections to validate these estimates. One should also consider the future appreciation this neighborhood will experience. The proximity to the University of Dayton, Downtown Dayton, and the River all but guarantee properties will be more valuable in the future.

Flood and Water Backup Coverage

Standard homeowners insurance excludes flood damage, yet Carillon’s proximity to the Great Miami River and its location in certain low-lying areas make flood risk a tangible concern, even outside FEMA-designated zones. Purchasing a separate flood insurance policy through the National Flood Insurance Program (NFIP) or private insurers is a prudent measure for homes near the river corridor.

Moreover, water backup coverage safeguards against damage stemming from sump pump failure or sewer backups—a frequent issue in older Carillon homes with finished basements. This endorsement is generally affordable and can prevent substantial repair costs.

Liability Limits and Umbrella Policies

Carillon’s elevated pedestrian traffic near public parks and walkways increases liability exposure. Homeowners should verify that liability limits are sufficient to cover potential injury claims. Ohio’s standard policies typically include $100,000 to $300,000 in liability coverage, but adopting an umbrella policy with coverage of $1 million or more provides an additional layer of protection against large claims.

Roof and Siding Matching Endorsements

Given that Carillon homes often feature unique brickwork and historic siding materials, repairs involving partial damage can become complex and costly. Matching endorsements help cover the expense of sourcing appropriate matching materials, preventing unsightly mismatches that can diminish property value.

Ordinance or Law Coverage

Local building codes and historic preservation requirements may mandate that rebuilding or repairs comply with updated standards. Ordinance or law coverage assists with these additional expenses, which are not covered under standard dwelling coverage. This coverage is especially pertinent in neighborhoods like Carillon, where many homes possess mid-century historic details.

Real-World Scenarios From Carillon Streets and Homes

Scenario 1: Basement Flooding After Heavy Rain

Mrs. Julian owns a 1950s brick home situated near a low-lying area in Carillon. Following a severe rainstorm, her sump pump fails, resulting in water flooding her finished basement. Because she did not carry water backup coverage, her standard homeowners policy excludes the damage. The total cost to repair drywall, flooring, and furniture reached $15,000, which she had to pay out-of-pocket.

Had she purchased water backup coverage, her insurer would have reimbursed these costs, minus the applicable deductible. This scenario underscores the critical importance of endorsements designed to address local moisture-related risks.

Scenario 2: Tree Limb Damage During Winter Storm

Mr. Hamilton’s mature oak tree lost a substantial limb during an ice storm, puncturing his roof and damaging gutters and siding. Because he maintained comprehensive liability coverage and promptly reported the claim, his insurer covered the roof repairs and siding replacement. However, the insurer required him to hire a certified arborist to assess and mitigate ongoing tree risks before policy renewal.

This example illustrates how mature landscaping, while aesthetically valuable, increases risk exposure. It also demonstrates the importance of proactive maintenance and open communication with insurers to prevent future losses.

Scenario 3: Total Loss and Rebuild Cost Discrepancy

A fire extensively damaged Ms. Jones’s mid-century home, featuring custom wood trim and oversized brickwork. Although the market value of her home was $220,000, the replacement cost estimate was $270,000 due to the historic materials and labor required. Since her dwelling coverage limit was set at $200,000, the insurance payout fell short by $70,000.

Ms. Jones had to personally cover the $70,000 difference, which delayed her rebuilding plans significantly. This costly outcome highlights the necessity for Carillon homeowners to collaborate with local experts to establish dwelling limits based on detailed replacement cost appraisals rather than market listing prices.

Student Rental Investors in Carillon: Special Liability & Landlord Considerations

As Carillon’s proximity to the University of Dayton continues to attract faculty, graduate students, and upper-level undergraduates seeking housing outside the core student neighborhoods, the area has increasingly come onto the radar of small landlords and individual investors. While Carillon is not traditionally viewed as a dense student rental enclave, its combination of single-family homes, quiet streets, and rapid access to campus has begun to generate interest among owners seeking stable, academically driven tenancy. This shift carries important insurance implications that differ from those encountered by primary homeowners or long-term residential landlords.

From an underwriting perspective, properties leased to students are generally classified as higher-risk due to elevated turnover, increased foot traffic, and the potential for accidental damage resulting from short-term residency patterns. Even well-intentioned student tenants may inadvertently contribute to losses through common issues such as improper use of appliances, neglected maintenance, or gatherings that create unanticipated liability exposures. Insurers often request additional documentation when underwriting homes used for student rentals, including written lease agreements, occupancy limits, and confirmation that the property meets local housing and fire safety requirements. Investors should be prepared for the possibility of stricter inspection standards or higher premiums reflective of this elevated risk profile.

Liability considerations are particularly significant for student rental properties. Carillon’s adjacency to Brown Street, Carillon Park, and pedestrian corridors connecting to the University of Dayton increases the likelihood that guests, visitors, and non-resident peers will be present at or near the property. Events such as slips and falls, injuries occurring on porches or walkways, or accidental property damage caused by visitors can quickly escalate into costly liability claims. Landlords must ensure they carry adequate liability limits—frequently $500,000 or more—and should strongly consider umbrella policies that extend coverage beyond standard landlord protections. These additional layers of coverage safeguard against the legal and financial exposure that can accompany high-occupancy or high-traffic rental scenarios.

Another important factor for Carillon investors is the preservation of mid-century architectural features and the heightened replacement cost associated with restoring older homes after a loss. Student rentals often experience more frequent minor damage—wear to flooring, stress on plumbing fixtures, damaged drywall, or accelerated roof and gutter deterioration from repeated use and seasonal weather exposure. While these issues may be routine, cumulative repairs can place pressure on cash flow and insurance claims history. Investors should work with insurers to ensure the dwelling limit is correctly established for a historic-era home and that endorsements covering water backup, matching materials, and ordinance or law considerations remain active.

Finally, rental investors must remain attentive to compliance with local ordinances, occupancy standards, smoke detector requirements, and zoning provisions that govern student housing near the university. Failure to adhere to these standards may not only affect insurability but can void coverage in certain claim scenarios. Partnering with an independent agent familiar with both landlord policies and the unique conditions surrounding university-adjacent housing in Dayton provides critical guidance for navigating these complexities.

Cost, Discounts, and Smart Ways to Control Premiums

While Carillon’s distinctive risks and housing features can elevate insurance premiums, homeowners can adopt strategic measures to optimize both coverage and cost.

Risk Mitigation: Regular maintenance of mature trees and electrical systems, timely upgrades to plumbing, installation and upkeep of functional sump pumps, and addressing drainage problems are effective risk reduction strategies. These proactive efforts reduce the frequency and severity of claims, which insurers reward with lower premiums.

Deductible Choices: Opting for higher deductibles can reduce premium costs, but homeowners must carefully balance this with their ability to pay out-of-pocket expenses in the event of a claim. For instance, increasing the wind/hail deductible from $1,000 to $2,500 might lower premiums by 10-15%, but necessitates confidence in covering a higher deductible if needed.

Bundling Policies: Purchasing multiple policies—such as home, auto, and umbrella coverage—from the same insurer or independent agent often yields multi-policy discounts, providing cost savings.

Security and Safety Features: Installing smoke detectors, security systems, and deadbolt locks can qualify homeowners for discounts. Ohio insurers recognize these features as effective in reducing fire and theft risks.

Claims History: Maintaining a claim-free record by promptly addressing minor maintenance issues and preventing losses positively influences insurance rates over time.

For a tailored quote that reflects your unique Carillon home and risk profile, contact Ingram Insurance to discuss discounts and coverage options specifically designed for Dayton residents.

Nearby Neighborhoods and How They Compare

Compared to these nearby neighborhoods, Carillon’s distinctive combination of historic homes, river adjacency, and park proximity creates a unique insurance landscape. While some neighboring areas contend more with urban density or commercial exposures, Carillon harmonizes residential tranquility with heritage tourism, influencing both risk factors and insurance requirements.

When and How to Review Your Policy if You Live or Own Property in Carillon

Regularly reviewing your home insurance policy is essential to ensure it aligns with changes in your home, neighborhood risk factors, and evolving insurance market conditions. Carillon homeowners should consider the following checklist and timing guidelines to maintain optimal coverage:

- Annually: Reassess dwelling coverage limits based on updated replacement cost appraisals. Review endorsements such as flood, water backup, and ordinance or law coverage for continued relevance.

- After Home Improvements: Notify your insurer of renovations that increase home value or alter risk profiles, such as installing a new roof, finishing a basement, or upgrading electrical or plumbing systems.

- Following Weather Events: After storms or regional flooding, reevaluate deductible selections and coverage adequacy to reflect current risks.

- Upon Changes in Local Codes or Historic Designations: Update ordinance or law coverage to accommodate new building code requirements or preservation mandates that may increase rebuild costs.

- When Shopping for Discounts: Inquire about new discount programs or policy enhancements offered by your insurer or agent.

Engaging with a knowledgeable local agent during these reviews helps ensure that your policy accurately reflects Carillon’s evolving risk environment and your personal circumstances.

Working With a Local Independent Agent Who Knows Carillon

Effectively insuring a neighborhood like Carillon requires a nuanced approach informed by intimate local knowledge. Independent agents based in Dayton, such as those at Ingram Insurance, possess invaluable expertise regarding the area’s housing stock, environmental risks, and market dynamics. They assist in tailoring policies that not only satisfy state requirements but also address the unique challenges and opportunities presented by Carillon.

Independent agents offer the significant advantage of access to multiple insurance carriers, enabling them to compare coverage options and pricing to find the optimal fit for each homeowner. Furthermore, they act as advocates during the claims process, guiding clients through the complex procedures of damage assessment, documentation, and reimbursement.

For residents seeking clarity, precision, and comprehensive understanding of home insurance, partnering with a local expert represents a critical step. Ingram Insurance’s deep Dayton roots and extensive experience serving Carillon homeowners position us uniquely to help you navigate coverage complexities and confidently protect your investment.

Ingram Insurance is based here in Dayton, serving homeowners, landlords, drivers, and business owners throughout Carillon. If you would like a second opinion on your coverage or a fresh, tailored quote, please call (937) 741-5100, email contact@insuredbyingram.com, or visit https://www.insuredbyingram.com/ to get started.