Insuring Vandalia’s Luxury Homes: What High-Value Homeowners Need to Know

Luxury homeowners in Vandalia face a very different set of insurance considerations compared to those in standard suburban neighborhoods. While Vandalia is known for its strong schools, convenient highway access, and quiet residential pockets, it also has a growing segment of higher-value homes—properties in the $400,000 to $600,000+ range with custom construction, premium finishes, and sophisticated home technologies. These homes require more than an off-the-shelf policy. From specialty materials and high-end mechanical systems to expanded liability and protection for valuables, securing proper coverage is essential. This guide breaks down what Vandalia’s luxury homeowners need to know to avoid gaps and ensure their property can be restored without compromise.

Insuring Vandalia’s Luxury Homes: What High-Value Homeowners Need to Know

Luxury in Vandalia looks different than in places like Oakwood or Washington Township—yet the insurance requirements can be just as complex. Homes in communities like Stonequarry, Maple Run, Meeker Creek, and other upscale pockets often include custom brick construction, oversized garages, expanded basements, high-efficiency HVAC systems, and upgraded interiors. These features elevate comfort and curb appeal, but they also increase the true cost of rebuilding.

A standard homeowner policy—especially one tied to a captive carrier—often fails to capture the full replacement value of these homes. That’s where a local, independent agency like Ingram Insurance provides an advantage. We understand the local market, know what materials actually cost in Montgomery County, and work with premium carriers capable of insuring higher-value residential risks. For a broader overview of how home insurance works in Ohio, you can also review our article What Home Insurance Actually Covers in Ohio.

What Makes Vandalia’s Luxury Homes Unique

Custom Materials and Elevated Craftsmanship

Even without reaching the million-dollar mark, many Vandalia luxury homes include:

- Brick or stone exteriors

- High-grade roofing and architectural shingles

- Custom kitchen cabinetry and stone countertops

- Hardwood flooring and upgraded trim packages

- Finished basements with entertainment spaces or home offices

These materials drive up reconstruction costs—often far beyond the home’s appraised market value. That’s why replacement-cost accuracy is essential. Your coverage should be based on what it would cost to rebuild your home today, not what you paid for it years ago.

Modern Mechanical and Smart-Home Systems

It’s increasingly common for Vandalia’s higher-value homes to feature:

- Dual-zone or multi-zone HVAC systems

- High-efficiency furnaces, boilers, or heat pumps

- Whole-home generators

- Hard-wired security and camera systems

- Smart thermostats, lighting, and irrigation controls

These systems require equipment breakdown coverage, which functions like a built-in home warranty within your insurance policy. Without it, a mechanical failure could mean thousands of dollars in out-of-pocket repairs. For more detail on why mechanical coverage matters, see our guide on Ohio HVAC Insurance.

Larger Properties and Higher Liability Exposure

Many upscale Vandalia homes include amenities such as:

- Pools or hot tubs

- Outdoor kitchens or built-in grills

- Extended patios and decks

- Larger yards and landscaped outdoor living spaces

- Multiple vehicles, trailers, or recreational equipment

These features increase personal liability risk. If someone is injured on your property, your legal and medical costs may extend far beyond the limits of a basic homeowners policy. That’s where a personal umbrella policy becomes critical.

Local Housing and Community Factors in Vandalia

Building Codes and Rebuild Requirements

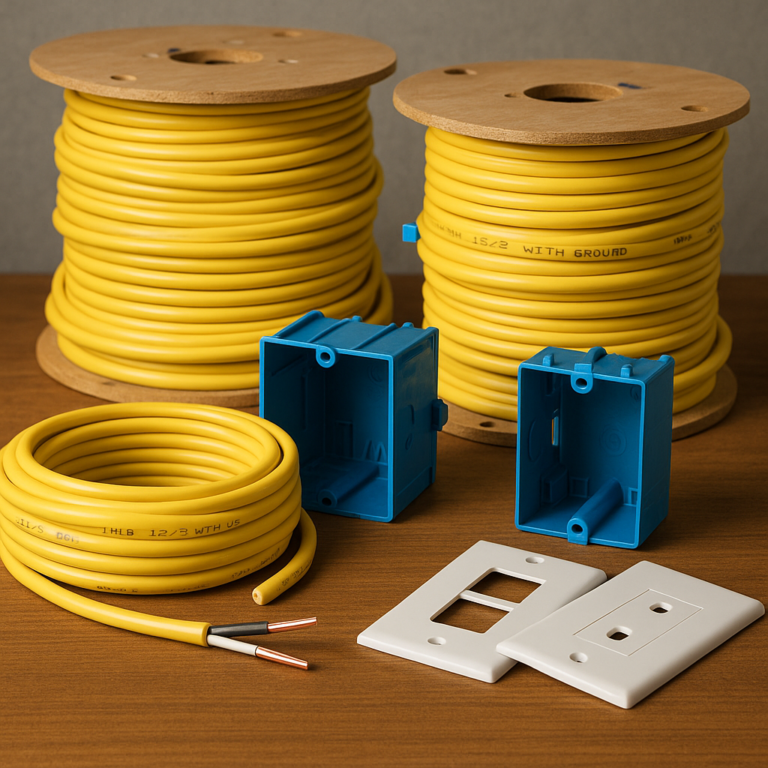

Even newer homes must meet updated Ohio building standards after a loss. Code changes can affect:

- Electrical systems and panel upgrades

- Plumbing and water supply lines

- Insulation and energy-efficiency standards

- Structural requirements for roof, walls, and foundations

This makes Ordinance or Law coverage essential—especially for homes built before the mid-2000s. Without it, you could end up paying out of pocket to bring your home up to current code during reconstruction.

Weather-Driven Risks in Northern Montgomery County

Vandalia experiences the same severe weather patterns seen across the Dayton metro area: wind, hail, heavy rain, and freeze–thaw cycles that put stress on roofing and masonry. Sump pump failures, basement water intrusion, downed trees, and power surges are all common triggers for claims.

For a deeper dive into how storms affect coverage in our region, read our article on What Homeowners in Dayton Need to Know About Storm Damage Coverage.

Vandalia’s proximity to major highways and the airport is also a draw for many buyers, and the city’s ongoing development and community investments—highlighted on the official City of Vandalia website—continue to support property values over time.

Core Coverages Every Vandalia Luxury Homeowner Should Consider

Guaranteed or Extended Replacement Cost

Luxury homes in Vandalia may not always be listed at seven figures, but their rebuild cost can still be substantial. Coverage that ensures the home can be rebuilt even if construction prices spike—often called Guaranteed Replacement Cost or Extended Replacement Cost—is critical in a market where rebuild costs can reach $200–$300+ per square foot for upgraded homes.

Equipment Breakdown Coverage

Equipment breakdown coverage can help protect:

- HVAC systems and boilers

- Built-in appliances and refrigeration

- Pool and spa systems

- Electric panels, generators, and circuit boards

- Smart-home hubs and connected devices

Instead of relying on multiple separate warranties (or paying cash), equipment breakdown coverage provides a single, broad safety net when critical systems fail due to a covered cause.

Water-Backup and Flood Protection

Finished basements—often housing family rooms, gyms, home theaters, or offices—are common in Vandalia’s higher-end homes. A sump pump failure or drain backup can cause tens of thousands of dollars in damage to flooring, drywall, furniture, and electronics.

Water-backup coverage is essential for these spaces, and certain locations may also benefit from a separate flood policy if they are near creeks, low-lying areas, or local drainage paths.

Scheduled Personal Property

Many Vandalia homeowners own items that exceed standard policy limits, including:

- Engagement rings and fine jewelry

- High-end watches

- Firearms collections

- Musical instruments and recording equipment

- Artwork or collectibles

Scheduled Personal Property coverage provides broader protection, often with no deductible and coverage for losses like mysterious disappearance—something a basic policy may not cover.

Cyber and Identity Theft Coverage

As more systems in the home connect to Wi-Fi—security cameras, thermostats, appliances, even sprinklers—the risk of cyber incidents continues to grow. Cyber and identity theft coverage can help with:

- Online fraud and unauthorized transfers

- Identity theft and account takeover

- Data restoration and system recovery

- Professional services to help repair your identity

Umbrella Liability Protection

Most luxury homeowners carry umbrella limits of at least $1 million, with many opting for $2–$5 million depending on their assets and lifestyle. If you host gatherings, own rental properties, or have significant savings and investments, umbrella coverage is a relatively inexpensive way to add an extra layer of protection above your home and auto policies.

Examples of Realistic Claim Scenarios in Vandalia

- Wind/Hail Roof Damage: A 2014 custom build with architectural shingles and upgraded underlayment requires a full roof replacement at current labor and material rates. Extended replacement cost coverage prevents a painful coverage shortfall.

- HVAC System Failure: A dual-zone furnace and A/C system fails after a power surge. Equipment breakdown coverage helps cover a $12,000 replacement that would not be covered under a basic homeowners policy.

- Basement Water Intrusion: Heavy rainfall overwhelms a sump pump, damaging a finished basement with a home theater setup. Adequate water-backup limits can mean the difference between full restoration and a major out-of-pocket expense.

- Smart-Home Breach: A compromised Wi-Fi security device leads to identity theft and fraudulent charges. Cyber coverage responds with credit monitoring, identity restoration services, and reimbursement for covered losses.

How Vandalia Homeowners Should Audit Their Policy

- Verify Replacement Cost: Confirm that Coverage A (dwelling) is based on current rebuild costs, not just market value or your mortgage amount.

- Review High-Value Belongings: Identify jewelry, collectibles, firearms, and other valuables that may need to be scheduled separately.

- Confirm Mechanical Protection: Check whether your policy includes equipment breakdown coverage for HVAC, electrical systems, and built-in appliances.

- Inspect Basement Coverage: Ensure water-backup limits are high enough to rebuild finished spaces and replace furniture, electronics, and gym equipment.

- Align Liability Protection: Work with your agent to set appropriate liability and umbrella limits based on your assets, income, and lifestyle.

- Document Upgrades: Keep records of recent updates—such as new roofs, electrical panels, or plumbing improvements—as many carriers offer credits or discounts for modernized systems.

Protecting the Luxury Home You’ve Built in Vandalia

Whether you live in a newer subdivision, a custom home on a larger lot, or one of Vandalia’s established higher-value neighborhoods, your property represents years of hard work and careful investment. A one-size-fits-all policy can leave dangerous gaps—especially when it comes to rebuild cost, mechanical systems, and liability limits.

With deep local expertise and access to multiple top-tier carriers, Ingram Insurance helps Vandalia homeowners build coverage that matches the quality of the homes they live in. If you’re unsure whether your current policy truly reflects your home’s value, a confidential review is a smart place to start.

Ready for a Personalized Review?

If you own a higher-value home in Vandalia or the surrounding Dayton suburbs, our team specializes in policies designed for exceptional properties. We’ll evaluate your current coverage, highlight potential gaps, and build a tailored protection plan for your home and lifestyle. To learn more about why working with an independent agency matters, read Why Everyone in the Miami Valley Should Work with an Independent Agent.

Ingram Insurance Group

733 Salem Ave, Dayton, OH 45406

Phone: (937) 741-5100 · Contact Us

Related Reading: What Home Insurance Actually Covers in Ohio · Ohio HVAC Insurance · Dayton Storm Damage Coverage · Why Work with an Independent Agent