Lithium Ion Battery Fire Insurance: Protecting Your World from Hidden Hazards

Lithium Ion Battery Fire Insurance: In our gadget-filled lives, lithium-ion batteries power everything from smartphones to electric vehicles (EVs). But with convenience comes risk—these compact powerhouses can overheat, swell, or even explode, leading to devastating fires. Recent data highlights the growing concern: In 2025 alone, the FAA reported 80 lithium-ion battery-related incidents on airplanes, nearly two per week. Meanwhile, the Fire Department of New York (FDNY) noted 19 non-structural fires caused by these batteries in early 2025, a slight decrease from the previous year but still alarming. Globally, fires involving lithium-ion batteries injured 586 people and claimed 104 lives in 2024, underscoring the need for awareness. This guide explores the causes, prevention strategies, and crucially, how various insurance policies can shield you from the financial fallout—putting a fresh perspective on staying safe in a battery-dependent era.

Understanding the Spark: Causes of Lithium-Ion Battery Fires

Think of lithium-ion batteries as tiny energy vaults: they’re efficient, rechargeable, and pack a punch with high energy density. You’ll find them in everyday items like laptops, e-bikes, power tools, and even cordless vacuums. However, trouble brews when things go wrong. Common triggers include:

- Physical Damage: Drops, punctures, or water exposure can cause short circuits, leading to rapid heating.

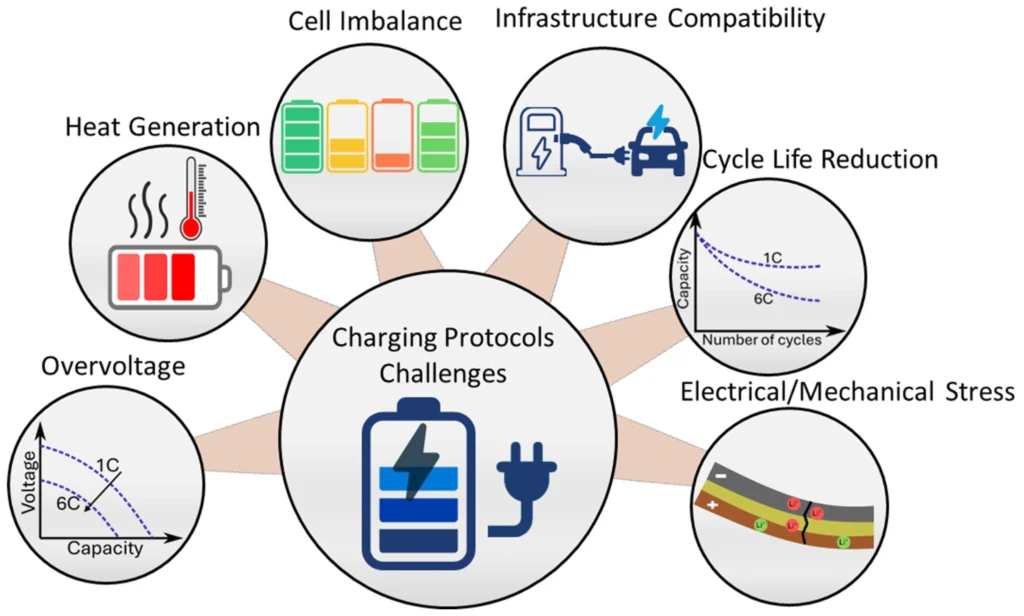

- Overcharging or Overheating: Using incompatible chargers or leaving devices plugged in too long can initiate “thermal runaway,” where the battery overheats uncontrollably, potentially exploding.

- Environmental Factors: Extreme heat, like storing an e-scooter in a hot garage, can make batteries swell or leak hazardous gases.

These incidents aren’t just theoretical—in waste facilities alone, the EPA recorded 245 fires over seven years linked to improperly discarded batteries. For EVs, the stakes are higher: Their large battery packs can produce intense, hard-to-extinguish fires if damaged in a crash or from faulty charging.

To visualize the potential destruction:

Taming the Flame: Practical Prevention Tips

Preventing battery fires is like fireproofing your daily routine—simple habits can make a big difference. Here’s a curated list blending expert advice for households, drivers, and businesses:

- Inspect Regularly: Before charging, check for swelling, leaks, or unusual heat. If something’s off, stop using the device immediately.

- Charge Smartly: Always use the manufacturer’s original or approved charger. Place devices on hard, non-flammable surfaces (like a kitchen counter) to ensure good airflow—avoid beds, couches, or enclosed spaces that trap heat.

- Avoid Overnight Charging: Opt for supervised sessions during the day. Many modern devices have built-in safeguards, but if yours doesn’t, time charges to match activities like meal prep.

- Store Wisely: Keep batteries in cool, dry places away from direct sunlight. For larger items like e-bikes or EVs, use ventilated garages and park away from structures.

- For EVs Specifically: Schedule regular electrical system checks, use proper charging stations, and ensure your home’s wiring can handle the load to prevent overloads.

- Disposal Done Right: Recycle damaged batteries at designated centers to avoid landfill fires.

Visual guides can help reinforce these habits:

By adopting these, you’re not just protecting property—you’re safeguarding lives, as seen in the drop in FDNY fatalities from 18 in 2023 to 6 in 2024 through better education.

Insurance Armor: What Covers You When Things Heat Up

Insurance coverage related to fires caused by lithium-ion batteries—whether from consumer electronics, electric vehicles, or power tools—is far more nuanced than many policyholders realize. While most standard insurance policies are designed to respond to fire losses, the source of the fire, the location where it occurs, and the use of the battery-powered device all influence how coverage applies.

Understanding how different insurance policies respond is critical, because battery-related fires often blur traditional coverage lines between home, auto, and business insurance. What follows is a breakdown of how coverage typically works by policy type, along with real-world considerations that frequently affect claims outcomes.

Homeowners Insurance

Homeowners insurance is generally the primary line of defense when a fire damages the structure of a home or the personal property inside it. Most standard homeowners policies cover fire as a named peril or as part of an “open perils” form, meaning damage caused by fire is covered unless specifically excluded.

In the context of lithium-ion batteries, this typically means that fire damage caused by common household devices—such as smartphones, laptops, tablets, cordless tools, or battery-powered appliances—is covered when those devices malfunction and ignite. If a battery overheats while charging on a nightstand or desk and causes a fire, both the structural damage to the home and the loss of personal property are usually eligible for coverage.

However, coverage may become more complicated when questions of negligence or maintenance arise. For example, if a policyholder continues using a visibly swollen or damaged battery, insurers may scrutinize whether the loss resulted from a preventable condition. While negligence alone does not automatically void coverage, it can affect claim evaluation, particularly if policy conditions related to reasonable care are implicated.

Electric vehicle (EV) charging introduces additional complexity. If an EV battery fire originates in the vehicle while it is parked in a garage, damage to the home may still be covered under the homeowners policy, but the vehicle itself is typically excluded as a “motor vehicle.” In these cases, the homeowners policy may pay for damage to the structure, while the auto insurance policy responds to damage to the car. Because EV charging infrastructure—such as wall-mounted chargers or upgraded electrical panels—can represent significant value, some homeowners benefit from endorsements that increase coverage limits or clarify treatment of permanently installed equipment.

Renters Insurance

Renters insurance plays a crucial role for tenants, but its scope is narrower by design. A standard renters policy generally covers a tenant’s personal property against fire damage, including losses caused by lithium-ion battery failures in devices like laptops, phones, e-bikes, or power tools.

If a battery-powered device ignites inside a rental unit, renters insurance can help replace damaged belongings and may provide personal liability coverage if the fire spreads and causes damage to other units or injuries to third parties. This liability component is often overlooked, but it can be financially critical in multi-unit buildings where a single fire can affect neighboring apartments.

What renters insurance does not cover is damage to the building itself—that responsibility lies with the landlord’s property insurance. However, renters can still be held personally liable if the fire is traced to their actions or equipment. This is particularly relevant for high-risk items such as e-bikes, scooters, or aftermarket battery packs, which may not be expressly contemplated in older policy language.

Coverage also depends on whether the policy is written on a named-perils or open-perils basis and whether any exclusions apply to certain types of devices or uses. Because tenants often assume “fire is fire,” they may not realize that policy limits, sub-limits, or exclusions can leave gaps. Reviewing the policy’s treatment of battery-powered mobility devices and charging practices is especially important for urban renters.

Auto Insurance

When fires involve vehicles or vehicle-mounted batteries, auto insurance becomes the primary responder. Coverage depends heavily on which part of the auto policy is in force and how the fire originated.

Collision coverage applies when a crash damages a battery-powered component and results in a fire. Comprehensive coverage, on the other hand, typically responds to non-collision events, such as spontaneous battery failure, electrical malfunctions, or fires caused by external heat sources. For electric vehicles, comprehensive coverage is often the section that addresses battery-related fires that occur without an accident.

The intersection of auto and homeowners insurance is especially important for EV owners who charge their vehicles at home. In many claims, the auto policy covers damage to the vehicle itself, while the homeowners policy addresses damage to the garage or dwelling. Disputes can arise if insurers disagree about the origin or spread of the fire, which is why having clear, well-coordinated coverage is important.

Optional endorsements and services—such as roadside assistance tailored to EVs—can also matter. While they do not prevent fires, they can reduce secondary risks by ensuring safe transport and handling of disabled vehicles or battery failures.

Business Insurance

For businesses, lithium-ion battery risks are often magnified by scale. Commercial property policies generally cover fire damage to buildings, equipment, and inventory, including fires caused by battery-powered devices used in offices, warehouses, or job sites.

However, businesses that store, sell, repair, recycle, or rely heavily on battery-powered equipment face more complex exposures. Standard policies may not adequately address risks associated with bulk battery storage, high-density charging stations, or specialized operations involving energy storage systems. In these cases, endorsements or specialized policies may be necessary to address explosion risk, contamination, or extended business interruption.

Commercial general liability policies may respond if a battery-related fire causes bodily injury or property damage to third parties, while business interruption coverage can help replace lost income during downtime. Landlords who lease space to battery-intensive operations should verify that tenant activities align with policy assumptions and that appropriate risk transfer mechanisms—such as certificates of insurance—are in place.

Lithium Ion Battery Fire Insurance: Pulling It All Together

Across all policy types, the outcome of a battery-related fire claim depends on several recurring factors: the cause of the fire, how the device was used or maintained, where the incident occurred, and the specific language of the policy. As lithium-ion technology continues to evolve and become more embedded in daily life, older policy forms may not always align neatly with modern risks.

A practical best practice is to document battery-powered devices, charging equipment, and any upgrades to electrical systems, and to review coverage annually with an insurance professional. This is especially important for households or businesses with electric vehicles, e-bikes, or high concentrations of rechargeable equipment.

Insurance can act as effective armor when things heat up—but only when it’s properly fitted to the risks you actually face.

If Disaster Strikes: Next Steps

Should a fire occur, prioritize safety: Evacuate, call emergency services, and use a Class D extinguisher if safe (water can worsen lithium fires). Post-incident, file a claim promptly with photos and receipts. Insurance can cover repairs, replacements, and even temporary housing, but prevention remains your best policy.

As we charge into a future with more EVs and smart devices, staying informed is crucial. Lithium-ion fires are on the rise in places like New South Wales, where they’re the fastest-growing risk. By blending smart habits with solid insurance, you can enjoy the power without the peril. For personalized advice, reach out to your insurer today—better safe than scorched!