Wolf Creek Landlord Insurance: Vacant Property Risks for Local Rentals

Managing rental properties in Dayton’s Wolf Creek neighborhood comes with a unique mix of opportunity and risk—especially when a home sits vacant. With aging mid-century housing, proximity to the Wolf Creek waterway, and the elevated moisture and maintenance challenges that come with the area’s natural terrain, landlords need a policy that understands local realities. This guide breaks down everything you need to know about Wolf Creek landlord insurance, including vacancy-related risks, water and flood exposure, liability concerns, real examples from local streets, and the coverage decisions landlords can’t afford to overlook. If you own rentals in Wolf Creek, this article will help you protect your investment with neighborhood-specific insights.

Wolf Creek Landlord Insurance: Vacant Property Risks for Local Rentals

For landlords and rental property owners in Wolf Creek, Dayton, managing vacant properties introduces an added layer of risk. This neighborhood’s combination of early 1900s homes, 1950–1980s mid-century construction, tall tree canopies, and the natural creek corridor creates a challenging environment for vacancy oversight. Understanding how these factors amplify insurance risks—from water intrusion to liability and vandalism—is crucial for safeguarding your investments. This guide breaks down the structural, environmental, and financial exposures that shape Wolf Creek landlord insurance, along with expert tips based on real local scenarios.

Meet Wolf Creek, Dayton Ohio

Wolf Creek is a nature-influenced Dayton neighborhood defined by mature trees, classic housing, and the serene creek that gives the area its name. Its residential character features older homes—many built between 1900 and the late 1980s—along with detached garages, alleys, and generous yards. Well-known local roads like Little Richmond Road, James H. McGee Boulevard, and Wolf Creek Pike anchor the community. Residents enjoy proximity to landmarks such as Residence Park, Dayton Metro Library – West Branch, and Wolf Creek Trail.

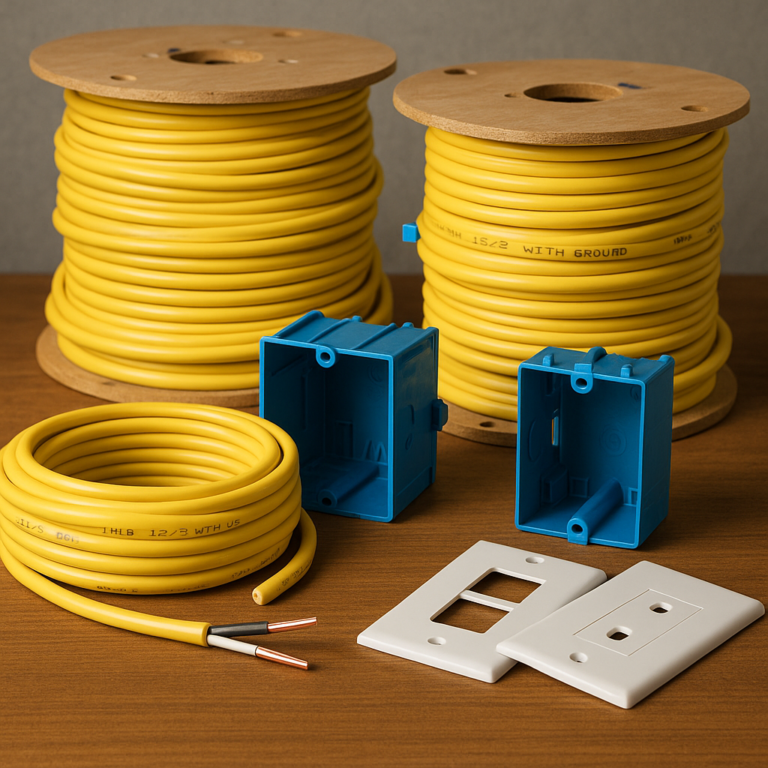

This varied housing stock often contains aging plumbing, wiring, and HVAC systems, all of which become more vulnerable when a property is left unoccupied. The creek’s floodplain brings added moisture concerns, particularly for basements and crawl spaces. These environmental and structural realities shape how risks appear—and why having the right Wolf Creek landlord insurance matters.

For a broader look at this neighborhood’s insurance needs, explore our full Wolf Creek homeowners insurance guide.

How Wolf Creek’s Built Environment Shapes Landlord Insurance Risk

Wolf Creek’s housing stock is durable but aging, which significantly affects vacancy risk. Older plumbing can freeze or leak, especially in unheated or unattended homes during Dayton winters. Outdated electrical systems increase fire risk if wiring degrades or if panels fail. Detached garages are common in the neighborhood and often need their own coverage for break-ins, vandalism, or storm damage.

The creek corridor elevates moisture exposure, raising the likelihood of basement seepage, sump pump strain, mold, and occasional flooding. These issues escalate during vacancy because small problems go unnoticed. Tall trees add to the risk: falling limbs, root intrusion into sewer lines, and storm damage are common concerns, particularly in older neighborhoods like Wolf Creek, Residence Park, and Westwood.

Key Insurance Risks for Landlords in Wolf Creek

Landlord and rental property insurance differs from standard homeowners insurance because it is built for income-producing properties and vacancy-related exposures. In Wolf Creek, several risks stand out:

1. Structural Deterioration During Vacancies

Unattended homes deteriorate faster. A vacant Wolf Creek rental with aging pipes, original windows, or an older roof is more susceptible to freeze damage, leaks, or moisture intrusion. Insurers may deny claims if vacancy clauses are violated.

2. Fire and Water Damage

Unmonitored electrical faults, malfunctioning furnaces, or sump pump failures can escalate quickly without a tenant present. Many landlord policies modify or limit coverage after 30 or 60 days of vacancy.

3. Liability Exposure

Vacant homes still pose liability risks—from icy walkways to unstable porches. Trespassers, contractors, or property inspectors could be injured, triggering claims.

4. Vandalism and Theft

While Wolf Creek is generally quiet, vacant homes anywhere can attract theft of copper, HVAC units, or appliances. Detached garages are particularly vulnerable.

5. Loss of Rents

Damage during a vacancy can extend downtime, delaying rental income. Proper loss-of-rents coverage ensures you stay financially stable during repairs.

How Landlord Insurance Works in Ohio (and What’s Different in Wolf Creek)

Ohio landlord insurance combines property protection, liability coverage, and loss-of-rents. However, Wolf Creek rentals require specialized attention to vacancy clauses and water-related risks. Most carriers restrict or exclude coverage if a property is vacant for longer than 30–60 days. Homes near the creek may require separate NFIP flood insurance.

Water backup coverage—which protects against sewer, drain, and sump pump failures—is especially important in older Wolf Creek basements. Tree-related damage may carry specific deductibles due to the neighborhood’s dense canopy.

For more on related water risks, see our guide on Loss of Rents Coverage in Ohio.

Coverage Decisions Wolf Creek Residents Can’t Afford to Get Wrong

Vacancy Limitations & Endorsements (Deep-Dive Analysis)

Vacancy is one of the most misunderstood components of landlord insurance, and in neighborhoods like Wolf Creek—where the housing stock often requires intentional turnover, upgrades, or seasonal maintenance—the vacancy clause becomes one of the most consequential parts of the policy contract. Most landlord policies in Ohio implement vacancy restrictions after 30 or 60 consecutive days of a property being unoccupied. However, what many landlords don’t realize is that “vacant” and “unoccupied” are distinct terms with very different underwriting consequences.

A property is generally considered unoccupied if it contains enough personal property to function as a residence and could be lived in without substantial additional setup. By contrast, a property is considered vacant when it contains minimal or no personal property and clearly isn’t being lived in. Wolf Creek landlords who are mid-rehab, preparing a unit for new tenants, or cycling through turnover periods may inadvertently trigger the vacancy definition without realizing it.

Vacancy impacts coverage in several ways:

- Certain perils may be excluded entirely. Common exclusions after the vacancy threshold include water damage from burst pipes, vandalism, glass breakage, theft of building materials, and sometimes even fire losses, depending on the insurer.

- Deductibles may increase. Some carriers apply a separate, higher deductible specifically for losses occurring during vacancy.

- Coverage types may convert automatically. A dwelling normally insured on a replacement cost basis may revert to actual cash value (ACV) during vacancy, reducing claims payouts significantly for older Wolf Creek homes with aged roofing, siding, or mechanical systems.

Given Wolf Creek’s older construction and the higher likelihood of periods of vacancy during repairs or renovations, landlords should consider vacancy permit endorsements or extended vacancy coverage riders. These endorsements essentially buy additional time—often extending the full coverage period to 60, 90, or even 180 days—before exclusions and restrictions activate. For portfolio landlords or owners with multiple mid-century Wolf Creek properties requiring staggered improvements, these endorsements can be the difference between a fully paid claim and an unexpected financial loss.

Flood and Water-Related Protections (Technical Considerations for Creekside Housing)

Wolf Creek’s defining natural feature—the creek itself—creates an elevated baseline of moisture, hydrological variability, and soil saturation. Although the neighborhood is not uniformly in FEMA-designated high-risk flood zones, many properties sit on land with moderate to elevated flood susceptibility, especially those closer to the creek bed, older homes with porous foundations, or structures built before modern grading and drainage standards.

Key technical considerations for landlords include:

1. Flood Insurance (NFIP vs. Private Market)

Standard landlord insurance policies explicitly exclude flood. Coverage for overland water must be purchased separately. NFIP policies provide standardized coverage limits and pricing based on FEMA flood maps, but private flood insurers may offer higher limits, shorter waiting periods, and optional coverage for finished basements—ideal for Wolf Creek’s sizable stock of mid-century homes with partially finished or utility-heavy lower levels.

2. Water Intrusion and Hydrostatic Pressure

Even properties outside flood zones face water-related hazards. Wolf Creek’s soil composition and tree density influence how water moves and drains. During heavy rainfall, hydrostatic pressure can build against foundation walls, pushing water through cracks or weakened concrete. Insurance does not cover groundwater intrusion, making foundation sealing, grading improvements, and sump pump redundancy essential risk-mitigation steps.

3. Sump Pump, Sewer, and Drain Backup Coverage

This is one of the most important endorsements for Wolf Creek landlords. Older sewer laterals, tree root intrusion, and outdated stormwater systems make backups more likely. Without a water backup endorsement, damage from a failed sump pump or clogged sewer line is not covered. Given that many Wolf Creek rentals include washers, dryers, and utilities in the basement, the financial impact of a backup can be substantial.

4. Mold Formation During Vacancy

Vacant properties near moisture sources experience a higher incidence of mold growth because humidity goes unmanaged. Most policies impose strict sublimits—or outright exclusions—for mold remediation. Landlords should evaluate optional mold coverage, where available, and implement strict vacancy inspection protocols.

Liability Coverage Levels (Risk Modeling for Aging Structures and Environmental Conditions)

Liability risk increases in older neighborhoods due to the structural designs common at the time of construction. In Wolf Creek, many properties feature:

- Raised front porches

- Narrow or steep staircases

- Aging concrete walkways

- Detached garages accessed via alleys or driveways

- Uneven or settling soil around entryways

- Large, mature trees that drop limbs or create root upheaval

These conditions magnify general liability exposure. Injuries involving stairs, steps, porches, or walkways are among the most frequent triggers for landlord liability claims—particularly during icy Dayton winters. Because medical and legal costs rise every year, the standard $100,000 liability limit is no longer adequate for most landlords.

From a risk-management standpoint, Wolf Creek landlords should consider:

- A minimum of $300,000 liability coverage, with many upgrading to $500,000 or $1 million.

- A personal or commercial umbrella policy for additional protection.

- Premises safety improvements, such as handrails, slip-resistant treads, motion lighting, and regular tree maintenance.

- Documented inspection routines (crucial evidence during claim disputes).

Detached garages and alleys—a hallmark of the neighborhood—add additional complexity. These areas often host contractor foot traffic, tenant storage, or vehicle access, increasing the likelihood of slip-and-falls or property damage claims. Liability insurance should reflect this elevated exposure.

Loss of Rents (Financial Stability Analysis for Wolf Creek Landlords)

Loss of rents coverage, often misunderstood or undervalued, becomes especially vital in neighborhoods where older homes require longer repair times or where turnover cycles can stretch beyond the typical 2–3 weeks. Wolf Creek properties, with their mix of mid-century mechanical systems, porous foundations, and creek-influenced environmental risks, tend to have:

- Longer restoration timelines after water or structural damage.

- Higher repair costs due to older materials and building specifications.

- Greater downtime following environmental events like windstorms or freeze–thaw cycles.

Loss of rents ensures that when a covered peril renders the unit uninhabitable, the landlord receives rental income while repairs are performed. However, not all policies calculate loss of rents the same way:

- Some use actual rent, while others apply a fair rental value formula.

- Some include waiting periods before payouts begin.

- Others impose maximum time limits, often 12–24 months.

Wolf Creek landlords—especially portfolio owners with multiple mid-century homes—should confirm that:

- The rental amount listed in the policy reflects the current market rate, not the rent from several years ago.

- The coverage period aligns with the typical repair duration in older homes, which can exceed modern construction timelines.

- The policy includes loss-of-rents triggered by water, fire, and other high-risk local perils, not just total losses.

In an environment where a single sump pump failure can remove a property from service for weeks, and where vacancy already amplifies risk, loss-of-rents coverage becomes a cornerstone of long-term financial stability.

Real-World Wolf Creek Scenarios

Scenario 1: Burst Pipe in a Vacant Mid-Century Rental

A landlord with a 1960s home near the creek experienced frozen pipes during a long winter vacancy. A vacancy endorsement saved the claim from denial.

Scenario 2: Tree Damage During a Windstorm

After a storm along Little Richmond Road, a fallen limb damaged a roof and detached garage. Because the property was occupied and trees were trimmed, the claim was paid without surcharge.

Scenario 3: Liability Claim on an Older Porch

A visitor slipped on an icy step and sued the landlord. Higher liability limits—recommended by their agent—covered the full settlement.

Smart Ways to Reduce Premiums

1. Increase Deductibles to manage premium cost.

2. Improve Security with alarms, lighting, and regular inspections.

3. Bundle Policies for multi-property or home/auto discounts.

4. Use Short-Term Vacancy Endorsements instead of year-round waivers.

Nearby Neighborhoods

Frequently Asked Questions About Wolf Creek Landlord Insurance

Does landlord insurance cover flooding in Wolf Creek?

No. Flooding from the creek requires separate NFIP or private flood insurance.

What happens if my Wolf Creek rental is vacant for over 30 days?

Your policy may limit or exclude coverage. Ask about vacancy endorsements.

Is water backup coverage important in Wolf Creek?

Yes—older basements and sewers make this coverage extremely valuable.

Do older Wolf Creek homes cost more to insure?

Often yes, due to older plumbing, electrical systems, and maintenance needs.

Does landlord insurance cover detached garages?

Yes, but coverage limits vary—especially for vandalism or theft.

What liability limit should a landlord carry?

Most landlords choose $300,000–$500,000 minimum, with many opting for $1M.

Work With a Local Agent Who Understands Wolf Creek

Ingram Insurance is based right here in Dayton, and we work with landlords across Wolf Creek, Residence Park, Westwood, and Southern Dayton View. Our team understands the aging homes, the creek corridor, the vacancy patterns, and the risks that are unique to this part of the city.

If you’d like a second opinion on your coverage or want to compare landlord insurance options, we’re here to help.

Call (937) 741-5100, email contact@insuredbyingram.com, or visit insuredbyingram.com to get started.