Ohio Rental Property Insurance: A Comprehensive Whitepaper for Landlords and Investors

Ohio has emerged as one of the most active rental property markets in the Midwest, driven by affordable acquisition costs, stable demand for single-family rentals, and favorable long-term appreciation trends in both urban and suburban communities. Yet despite the scale of this market, rental property insurance remains one of the least understood and most inconsistently applied components of an investor’s financial protection strategy. Many landlords either assume that their standard homeowners policy will extend to a tenant-occupied property or believe that all “landlord” insurance is functionally identical. In practice, neither assumption is true. Rental property insurance varies substantially depending on the home’s age, the condition of core systems, occupancy type, lease structure, geographic location, and its position within an investor’s portfolio. This whitepaper examines rental property insurance in Ohio through a comprehensive lens, focusing on structural coverage, underwriting dynamics, regional risk exposures, and the common coverage gaps that leave landlords vulnerable to catastrophic loss.

Ohio Rental Property Insurance: A Comprehensive Whitepaper for Landlords and Investors

1. The Structural Role of Rental Property Insurance in Ohio’s Real Estate Landscape

Rental property insurance is designed to protect non-owner-occupied dwellings, typically referred to as dwelling fire or DP policies. This form of coverage represents a foundational requirement for landlords because the risks associated with tenant occupancy differ significantly from those present in owner-occupied homes. Investors often underestimate this distinction. A home with a tenant requires a different risk model, a different claim frequency expectation, and different underwriting criteria. Insurance carriers evaluate these factors holistically, using them to determine pricing, eligibility, and available endorsements.

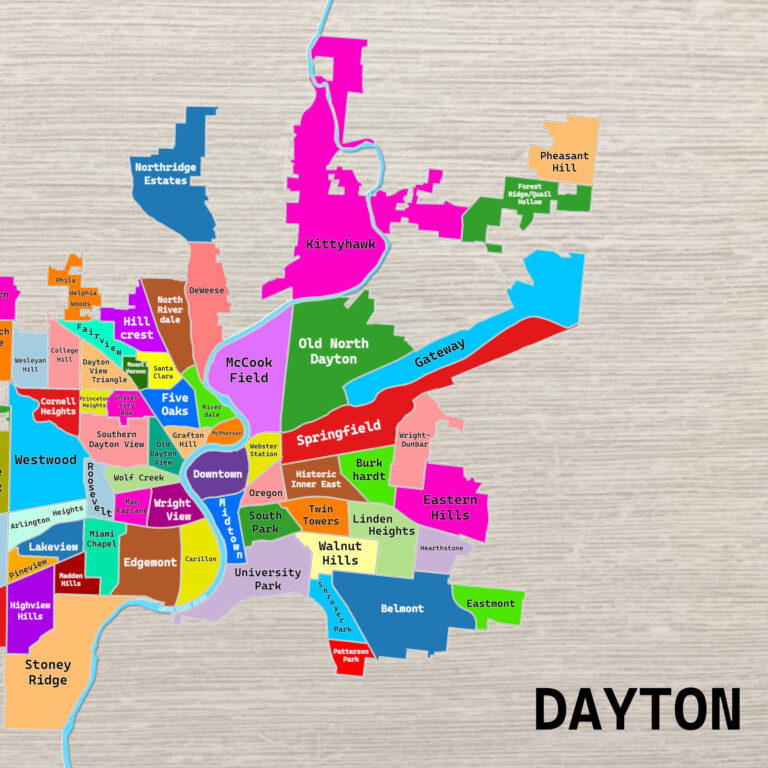

Ohio’s rental market spans a wide variety of housing types: older single-family homes in Dayton and Toledo, renovated multifamily units in Columbus, large suburban rentals near Cincinnati, and manufactured housing across rural counties. Each configuration presents a unique combination of structural vulnerability, maintenance obligations, and liability exposure. Older housing stock, for example, is prone to losses driven by aging electrical systems, outdated plumbing, or deferred maintenance from prior owners. Multifamily buildings may have shared walls, aging mechanical systems, or higher turnover. Meanwhile, scattered-site single-family rentals involve geographical spread, which complicates risk management and increases the chances of unobserved damage between tenant transitions.

Insurance underwriters must account for these variables, and landlords must understand that their coverage is not simply an administrative requirement but a critical part of their investment protection framework. The goal of rental property insurance is not only to pay for losses after they occur but to serve as a risk stabilization mechanism that preserves cash flow, equity, and long-term portfolio viability.

2. Core Components of Ohio Rental Property Insurance

Although dwelling fire policies vary widely, the foundational components remain consistent. The core of the policy is dwelling coverage, which insures the physical structure of the home against a list of covered perils. These typically include fire, wind, hail, lightning, vandalism, and explosions. Ohio experiences frequent windstorms, rapid temperature shifts, and recurring hail cycles, which place significant stress on roofs, windows, exterior walls, and mechanical systems. A rental home must be able to withstand these environmental pressures, and insurance must be capable of providing adequate replacement cost or actual cash value settlement depending on the home’s age and updates.

Liability coverage is equally essential. Landlords may be held responsible for bodily injury or property damage that results from unsafe conditions on the property. In older Ohio neighborhoods where porches, handrails, and steps have deteriorated or shifted over time, liability exposure is substantial. Courts often evaluate whether a landlord maintained reasonable safety conditions and responded appropriately to known hazards. A comprehensive liability endorsement protects the investor financially when these claims arise.

Loss of rental income coverage is another indispensable component, designed to replace the rental income that would have been collected if a property becomes uninhabitable due to a covered loss. Investors relying on consistent cash flow to service debt or maintain liquidity benefit significantly from this protection. Ohio’s repair timelines can stretch during storm seasons, meaning a landlord may lose months of rental income if this coverage is not included.

Finally, landlord-owned personal property coverage applies when the investor supplies appliances, furnishings, or equipment that remain on the premises. Many investors unknowingly leave refrigerators, stoves, or washers and dryers uninsured, creating financial gaps during claims. Rental property insurance allows investors to protect these assets through an added endorsement.

3. Key Risk Factors Affecting Ohio Rental Properties

Ohio rental properties face several major categories of risk that influence underwriting decisions and claim outcomes. Understanding these risks is essential for investors seeking to manage their portfolios effectively.

Water damage is among the most frequent and costly losses. Ohio’s large inventory of pre-1990 homes often includes older plumbing systems, galvanized steel pipes, or mixed plumbing upgrades that create failure points. Frozen pipes are a recurring issue in the winter months, especially in homes with insufficient insulation, drafty crawlspaces, or unoccupied units between tenants. Roof leaks affect a substantial portion of claims as well, particularly in rental homes that have not undergone recent roofing upgrades. Even minor roof issues can lead to significant damage to ceilings, walls, and flooring systems.

Wind and hail risk is substantial throughout the state. Western Ohio, in particular, is prone to straight-line winds capable of removing shingles, damaging siding, and compromising soffits. Multifamily buildings and duplexes often experience wind funneling between structures, accelerating damage patterns. Single-family rentals with older roofs—particularly those with aging three-tab shingles—are disproportionately affected.

Fire claims represent another high-severity risk. Tenant behavior, outdated electrical systems, and deferred maintenance contribute to fire losses more frequently in rental properties than in owner-occupied homes. In older neighborhoods, electrical panels may not meet modern safety standards, and tenants may use space heaters or overload outlets. Fire incidents often result in total or near-total losses, making proper dwelling valuation essential.

Liability claims arise from slip-and-fall incidents, structural failures, dog bites, and hazards on the property. Ohio’s freeze-thaw cycles cause driveways, sidewalks, and porch structures to shift or crack, increasing the risk of injury. These liability exposures require landlords to adopt proactive maintenance strategies and ensure sufficient liability limits.

4. Replacement Cost vs. Actual Cash Value in Rental Property Policies

One of the most consequential distinctions in landlord insurance revolves around the valuation method used to settle claims. Replacement cost coverage pays the full cost to repair or rebuild the damaged portion of the property without deducting depreciation. Actual cash value (ACV), on the other hand, applies depreciation based on the age and condition of the structure. Investors often misunderstand this distinction, assuming replacement cost is standard. In reality, many older homes in Ohio default to ACV due to underwriting restrictions.

The financial implications are substantial. A roof replacement estimated at $12,000 may result in an ACV payout of only $4,000 to $5,000, depending on the roof’s age and wear. Investors relying on cash flow to cover debt service may experience significant financial strain under ACV settlements. The availability of replacement cost for older homes depends on factors such as roof updates, electrical upgrades, plumbing modernization, and overall condition. Carriers evaluate whether the home’s systems meet contemporary safety standards before offering full replacement cost.

5. How Updates, Renovations, and Property Age Affect Underwriting

Underwriting for rental property insurance in Ohio is deeply influenced by the home’s construction year and the age of its major systems. Homes built before the 1970s frequently contain original wiring, older plumbing systems, or non-standard electrical panels. These characteristics increase risk and may limit available coverage forms. Homes built in the 1990s or later typically face fewer underwriting restrictions, though their claim frequency still correlates with roof age, occupancy trends, and tenant turnover.

Investors renovating older properties should understand how updates influence insurability. Replacing old plumbing with PEX or copper significantly reduces water loss risk. Installing modern electrical panels eliminates fire hazards associated with outdated brands. Roof replacements mitigate wind and water risk. Underwriters favor properties with documented renovations, and investors who maintain detailed records often receive broader coverage options. Renovating a rental property not only protects tenants and preserves the asset but also expands the range of carriers willing to insure the home.

6. Coverage Gaps Common Among Ohio Rental Property Owners

Coverage gaps represent one of the most significant threats to the financial stability of Ohio landlords. These gaps often arise when owners assume certain protections are automatically included in a standard rental property policy. Understanding these gaps—and correcting them through endorsements—can prevent substantial financial losses.

6.1 Water Backup and Sump Overflow

Water backup is one of the most common and financially damaging losses for Ohio rental properties. This coverage is not included by default in most landlord policies and must be added by endorsement. Ohio’s aging sewer infrastructure, combined with frequent rainfall and older basement designs, creates a high probability of water entering the home through drains or sump systems. Landlords often underestimate the severity of these losses, which can include subfloor damage, contaminated flooring, and mold development. Cleanup costs may range from several thousand to tens of thousands of dollars, depending on severity. Without this endorsement, such losses are usually excluded.

6.2 Service Line Failures

Service line coverage protects underground utility lines such as sewer, water, and electrical conduits connecting the home to municipal systems. Ohio neighborhoods—particularly those developed before the 1980s—frequently experience service line failures due to aging materials, soil movement, and root intrusion. These failures create costly excavation and repair needs, which traditional landlord policies exclude. Service line coverage fills this gap and is especially valuable for investors managing older homes.

6.3 Equipment Breakdown Coverage

Rental homes rely on essential mechanical systems such as furnaces, air conditioning units, water heaters, and kitchen appliances. Mechanical breakdowns of these systems are generally excluded under standard policies because they fall under “wear and tear.” Equipment breakdown coverage provides protection against electrical surges, motor burnout, and mechanical failure. For rental properties, this endorsement is particularly valuable because system failures disrupt tenant satisfaction and may lead to disputes or rent concessions. Ohio’s frequent temperature swings place additional strain on HVAC systems, making this coverage especially relevant.

6.4 Replacement Cost on Older Homes

Many Ohio rental properties—particularly in Dayton, Toledo, Canton, and Akron—are 60 to 100 years old. These homes often default to actual cash value coverage due to age-related underwriting limitations. Replacement cost endorsements may be available if the home has undergone significant updates, but investors must proactively request them. Without replacement cost, depreciation significantly reduces claim payouts, compromising the investor’s ability to repair major damage. This coverage gap is one of the most financially consequential for landlords managing older housing stock.

6.5 Tenant-Caused Damage

Tenant-caused losses fall into a gray area within rental property insurance. Some policies cover vandalism but exclude damage resulting from negligence or misuse. Examples include broken doors, damaged flooring, or kitchen fires caused by unattended cooking. These gaps create financial complications for landlords, particularly during tenant turnover. Investors must understand the limitations of their policy and consider security deposits, inspections, and lease provisions to mitigate this risk.

6.6 Detached Structures and Exterior Additions

Detached garages, sheds, porches, and carports often require explicit listing in the policy. Investors who fail to schedule these structures may receive minimal or no payout after a loss. Detached structures represent meaningful financial value, especially in older neighborhoods where garages are frequently separate from the primary structure. Rental property policies vary widely in their default coverage limits for these components.

6.7 Mold Remediation

Mold remediation is generally excluded from standard landlord policies unless specifically endorsed. Ohio’s humidity levels and frequent rain create conditions conducive to mold growth, particularly in basements and older homes with ventilation challenges. Mold claims can be expensive and time-consuming, involving specialized cleaning, structural repair, and preventive measures. Without a mold remediation endorsement, landlords must absorb these costs directly.

6.8 Flood Coverage

Flood damage is excluded from nearly all rental property policies. Properties located near rivers, lakes, or low-lying areas are particularly vulnerable. Flood insurance must be obtained separately through the National Flood Insurance Program or private flood carriers. Landlords unfamiliar with flood zone designations may underestimate their exposure. Rising water from outside the home—regardless of severity—is not covered by standard policies.

6.9 Ordinance or Law Coverage

Older Ohio homes frequently require code upgrades during repairs. Ordinance or Law coverage pays for the increased cost of construction required to meet current codes after a claim. Without this endorsement, landlords must pay the difference out of pocket. Examples include electrical upgrades, structural reinforcement, or mandatory insulation improvements.

7. Liability Considerations for Ohio Landlords

Liability exposure is one of the most underappreciated risks for rental property owners. Slip-and-fall accidents, dog bites, deck or staircase failures, and environmental hazards all create potential liability. Ohio courts evaluate whether landlords maintained safe conditions and responded to known hazards promptly. Effective liability coverage protects investors from catastrophic loss. Landlords should ensure their liability limits reflect the value of their assets and potential exposure, particularly when operating multiple properties or a larger portfolio.

8. Loss of Rental Income: Cash Flow Protection for Investors

Loss of rental income coverage preserves cash flow when a rental property becomes uninhabitable due to a covered loss. This protection is essential for investors who rely on rental income to service debt or maintain liquidity. Without this coverage, a fire, severe water loss, or storm-related damage could interrupt rental income for months. Ohio’s repair timelines can be extended during peak storm seasons or in areas with high contractor demand. Loss of rental income coverage ensures stability during these periods.

9. Why Independent Agencies Provide Superior Options for Ohio Landlords

Independent agencies have access to multiple insurance carriers, each with distinct underwriting guidelines and risk appetites. This enables investors to secure coverage tailored to their property’s condition, location, and occupancy type. Some carriers specialize in older homes, others in newer construction or multi-location portfolio policies. Independent agents can match each property with the most appropriate carrier based on its risk profile. This flexibility is critical for investors managing diverse portfolios across Ohio’s varied housing markets.

10. Obtaining a Rental Property Insurance Quote

Investors seeking rental property insurance should prepare key property information such as the home’s construction year, roof age, heating system type, electrical panel details, plumbing materials, and occupancy status. Providing accurate information enables underwriters to evaluate the property efficiently and determine available coverage forms. With proper documentation, landlords can secure comprehensive coverage tailored to their investment objectives and risk tolerance.

For expert assistance with Ohio rental property insurance, investors may contact (937) 741-5100 for a comprehensive policy review and tailored coverage options.

If you prefer to review this information or discuss rental property insurance in Spanish, we have prepared a dedicated resource to assist you. You can visit our Spanish-language page on rental property insurance by clicking the link below:

Haga clic aquí para obtener información sobre el seguro de propiedades de alquiler en español.