Auto Insurance in Huber Heights 45424

Understanding Auto Insurance Coverage

Auto insurance is a critical safeguard for drivers in Huber Heights and throughout Montgomery County. It provides financial protection against losses resulting from vehicle accidents, theft, or damage. At its core, auto insurance covers liability for bodily injury and property damage to others, collision damage to your own vehicle, comprehensive coverage for non-collision incidents like theft or weather-related damage, and often medical payments or personal injury protection. Knowing how these coverages work together helps drivers in the 45424 ZIP code make informed decisions about the protection they need on the road.

Liability coverage is mandatory in Ohio and protects you if you cause injury or damage to others. Collision coverage pays to repair or replace your vehicle after an accident regardless of fault, while comprehensive coverage addresses risks like vandalism, theft, or weather events. Additional options such as uninsured motorist coverage and roadside assistance can further enhance your protection. Understanding these components ensures that drivers in Huber Heights have the right balance of coverage tailored to their specific needs.

The Local Context: Huber Heights and Its Impact on Auto Insurance

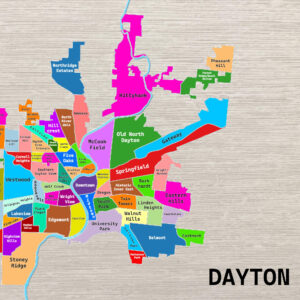

Huber Heights, located in Montgomery County within the Miami Valley region, is a primarily suburban community characterized by planned neighborhoods developed between 1960 and 1990. The area features a mix of brick ranches and two-story homes with a strong rate of owner occupancy. This suburban setting influences the nature of auto insurance risks and claims in the 45424 ZIP code.

The city’s layout includes wide subdivisions and residential streets, which generally reduce the frequency of high-speed collisions common in urban centers. However, the exposure to weather-related risks such as wind damage during thunderstorms is slightly elevated due to the open spaces and tree-lined streets. Major roads like Interstate 70, Ohio 4, Old Troy Pike (Ohio 202), Brandt Pike (Ohio 201), Chambersburg Road, and Fishburg Road serve as key arteries for daily commuters and local traffic, shaping the driving environment and risk profile.

Landmarks such as the Rose Music Center at The Heights and the retail corridor along Brandt Pike attract visitors and increase traffic volume during events and peak shopping times, which can influence accident patterns. To the northeast, the Carriage Hill MetroPark and surrounding farming heritage areas introduce occasional rural driving conditions, requiring awareness of different road surfaces and potential agricultural vehicles.

ZIP Code 45424 Risk Factors and Claim Patterns

Within the 45424 ZIP code, typical claim patterns reflect the suburban character of Huber Heights. Most claims arise from minor collisions on residential streets or at intersections along busy corridors like Brandt Pike and Old Troy Pike. Rear-end collisions and parking lot incidents are common due to the volume of local shopping centers and community events.

Weather-related claims are notable during storm seasons, with wind damage causing broken windows or dents from debris. While theft rates are moderate compared to urban centers, vehicle break-ins occasionally occur near retail areas and public parks. Drivers in this ZIP code also face risks associated with commuting on Interstate 70 and Ohio 4, where higher speeds and traffic density increase the potential for more severe accidents.

Understanding these local risk factors helps drivers anticipate the types of coverage that are most relevant. For example, comprehensive coverage is important to address weather-related damage, while liability and collision coverage remain essential for protection against the frequent minor accidents typical in this suburban environment.

How Auto Insurance is Priced in Huber Heights 45424

Auto insurance premiums in the 45424 ZIP code are influenced by a combination of factors including local traffic patterns, claim history, and the demographic profile of Huber Heights. Insurers consider the mix of suburban residential neighborhoods, the presence of major roads like Interstate 70 and Brandt Pike, and the frequency of weather-related claims when setting rates.

Because Huber Heights features planned subdivisions with strong owner occupancy, insurers often view the area as relatively stable with moderate risk. However, the proximity to busy commercial corridors and event venues can increase exposure to accidents, which is factored into pricing. Weather patterns, particularly the risk of wind damage during thunderstorms, also contribute to the overall premium calculation.

Drivers with clean records and vehicles equipped with safety features may benefit from lower rates, while those with recent claims or coverage gaps might see higher premiums. Overall, the pricing reflects a balance between the suburban environment’s generally moderate risk and the specific challenges posed by local traffic and weather conditions.

How Ingram Insurance Can Help Tailor Your Coverage

At Ingram Insurance, located in the heart of Dayton and serving the Huber Heights community, we understand the unique auto insurance needs of drivers in the 45424 ZIP code. Our local expertise allows us to assess your individual risk factors, driving habits, and vehicle type to recommend coverage that fits your lifestyle and budget.

We recognize the importance of protecting you against the specific risks found along major routes like Ohio 4 and Old Troy Pike, as well as the weather-related exposures common in this part of Montgomery County. Whether you need comprehensive coverage to guard against storm damage or liability protection tailored to your commuting patterns, our independent agency works with multiple carriers to find the best options.

Our team is committed to providing clear, practical advice without unnecessary complexity. We help you understand your policy details, identify potential coverage gaps, and adjust limits to ensure you have adequate protection. By partnering with Ingram Insurance, drivers in Huber Heights gain a trusted resource that combines local knowledge with personalized service to secure the right auto insurance coverage for their needs.

Ingram Insurance

733 Salem Ave, Dayton, OH

Phone: (937) 741-5100

Email: contact@insuredbyingram.com

Website: https://www.insuredbyingram.com

“`

Insurance Options in 45424

Explore other insurance coverages available in the 45424 area:

- Auto Insurance in 45424

- Homeowners Insurance in 45424

- Renters Insurance in 45424

- Landlord Insurance in 45424

- Business Insurance in 45424

- SR-22 Insurance in 45424

- Flood & Weather-Related Insurance in 45424

- Contractor Insurance in 45424